KARACHI, Jan 8: Stocks on Tuesday staged a snap rally and rose from the overnight lower levels on active short-covering signalling that investors have decided to go along the positive market fundamentals rather than the current irritants.

Price flare-ups on selected counters reflect that leading shares are virtually racing towards their pre-reaction levels on strong short-covering at the lower levels.

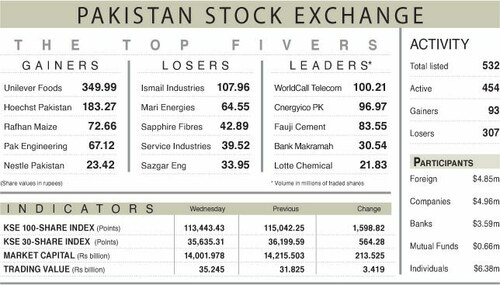

The KSE 100-share index firmly settled above the barrier of 14,000 points at 14,319.19 as compared to previous 14,163.11, up by 156.08 points or 1.10 per cent.

Leading bank shares, notably MCB, National Bank, Engro Chemicals, Attock Refinery, OGDC and PTCL led the market advance.

The 30-share index on the other hand recovered 219.56 points or 1.31 per cent at 16,923.42, reflecting the strength of leading base shares.

“Future economic indicators may not be that encouraging and investors seem to have decided not to go along with them and were back in the arena again on the strength of positive corporate outlook,” analyst Ahsan Mehanti said, adding “a sharp rebound just on the heels of decline reflects this phenomenon”.

News from the tribal areas, election uncertainties and a fragile law and order situation did worry them but leading investors were not deterred by the compulsions and tried to keep the wheels moving.

However, bulk of the interest remained confined to some of second-liners, which together accounted for more than a half of the total volume, analyst Hasnain Asghar Ali said.

Stock analyst Ashraf Zakaria was of the view that higher earnings by the oil, banking and some other sectors whose financial year ended on Dec 31, were the market movers amid reports of higher payouts.

Top gainers were led by JS & Co and Rafhan Maize, up by Rs55.75 and Rs115, followed by Adamjee Insurance, Engro Chemical, BOC Pakistan, Attock Petroleum, Attock Refinery, Arif Habib Ltd, EFU General, IGI Insurance, Shell Pakistan and Pakistan Engineering, which posted gains ranging from Rs10 to Rs21.35.

HinoPak Motors and Nestle Pakistan were leading among the losers, off by Rs17 and Rs30 respectively. Other prominent losers included Berger Paints, Gillette Pakistan, Pakistan Services, Service Industries, Fazal Textiles, New Jubilee Insurance, Colgate Pakistan and Bata Pakistan, off by Rs6 to Rs14.

Trading volume rose to 256m shares from the previous 245m shares as gainers held a strong lead over the losers at 205 to 131 with 33 shares holding on to the last levels.

The most active list was topped by NIB Bank, firm by 80

paisa at Rs23.95 on 29m shares, followed by TRG Pakistan, steady by 25 paisa at Rs14.10 on 24m shares, Bosicor Pakistan, up by 35 paisa at Rs21.35 on 12m shares, Arif Habib Securities, higher by Rs1.70 at Rs172.25 also on 12m shares and Fauji Fertiliser Bin Qasim, up by Rs1.15 at Rs44.25 on 11m shares.

National Bank followed them, higher by Rs4.50 at Rs234 on 10m shares, Engro Chemical, up by Rs10 at Rs271 also on 10m shares, OGDC, up by 15 paisa at Rs121.10 on 8m shares and PTCL, steady by 10 paisa at Rs41.20 on 9m shares.

FORWARD COUNTER: National Bank led the list of actives on the cleared list, up by Rs4.50 at Rs235 on 4m shares followed by MCB, higher by Rs4.25 at Rs396.25 also on 4m shares and Engro Chemical, up by Rs8.60 at Rs271.50 on 4m shares.

Lucky Cement followed them, firm by Rs2.50 at Rs122 on 3m shares and D.G. Khan Cement, up by 70 paisa at Rs95.85 also on 3m shares.

DEFAULTER COMPANIES: Unity Modaraba again came in for strong support at the previous level of Rs1.75 on 5.082m shares followed by Zeal Pak Cement, up by 10 paisa at Rs4.75 on 1.584m shares and Norrie Textiles, steady by 10 paisa at Rs2.15 on 0.695m shares.

Pangrio Sugar was quoted higher by Rs1.30 at Rs27.40 on 0.169m shares followed by Invest CapitalBank, unchanged at Rs6.65 on 0.149m shares.

--------------------------------------------------------------------------------------------------------------------------------

Jan 8,2008

Market at a glance

TONE:firm,total listed 652,actives 369,inactives 283,plus 205,minus 131,unc 33

KSE 30-SHARE INDEX:previous 16,703.86,Tuesday’s 16,923.plus 219.56 points

KSE 100-SHARE INDEX:previous 14,163.11,Tuesday’s 14,319.19,plus 156.08 points

MARKET CAPITAL;previous Rs4,324.776bn,Tuesday’s 4,372.675bn,plus 47.899bn

TOP TEN:gainers Rafhan Maize Rs115.00,JS & Co 55.75,EFU General 21.35,IGI Insurance 18.50,Pakistan Engineering 16.50.

LOSERS: Nestle Pakistan Rs30.00,HinoPak Motors 17.00,Colgate Pakistan 14.25, Bata Pakistan 14.00,Pakistan Services 12.50.

TOTAL VOLUME:255.606m shares

VOLUME LEADERS:NIB Bank 29.289m,TRG Pakistan 24.370m,Bosicor Pakistan 12.116m,Arif Habib Securities 11.906m,Fauji Fertiliser Bin Qasim 11.215m shares.

Dear visitor, the comments section is undergoing an overhaul and will return soon.