KARACHI, Feb 19: The share market on Tuesday welcomed the outcome of national elections as investors flooded the market with fresh buy-stops after people spoke enthusiastically in favour of a strong coalition government at the centre and the provinces, analysts said.

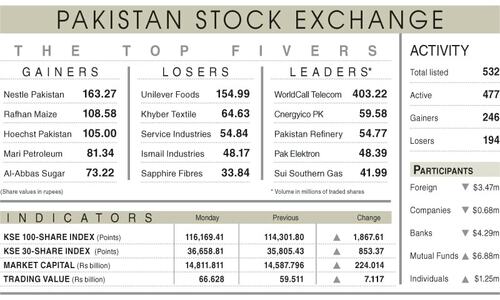

An idea of buying euphoria may well be had from the fact that the KSE 100-share index soared by 3.09 per cent or 443.34 points at 14,797.18, adding Rs138 billion to the market capital at Rs4.6 trillion.

However, it was not a single session high as it had risen by 643.04 points at 13,996.83 on Jan 3, 2008 (or well over 500 points many times earlier) after the postponement of elections after the assassination of former prime minister Benazir Bhutto on Dec 27.

The all-time high so far was hit at 14,814.85 points on Dec 26, 2007 on year-end short-covering by the financial institutions. The free float 30-share index on the other hand rose by 652.29 points at 17,948.26.

Although there may still be many a slips between the cup and the lip, the initial KSE welcome to the people’s verdict reflects that the future economic outlook may be positive despite the fact that the monster of inflation and deficit financing will continue to haunt the new political set-up for quite sometime.

But some others said the real market direction will be known after the transfer of power to the elected members as rigid positions taken by some of the leading winners on some issues, including restoration of supreme courts judges, could lead to a confrontation between the contenders of power.“Both the leading winning parties, PPP and PML-N are considered to be the chief exponent of dominating role for the private sector”, analysts said “their previous performance on the economic front may not be that ideal but investors seem to have given them another chance in a democratic set up.”

In their previous regimes about 400 new companies were listed on the KSE, raising the total number listed companies to 962, which now has been reduced to 652 for various reasons, including delisting and mergers.

Leading base shares led the market advance under the lead of OGDC, PTCL, National Bank, MCB Bank, Pakistan Petroleum and some others, which came in for strong support at the current levels as they all ensure handsome capital gains. Most of them ended with upper locks as prices had risen by five per cent in a session.

Meanwhile, according to KSE sources an MoU has been signed between the KSE and Dubai Securities Market on Feb 17, to develop and strengthen capital markets activities in the region.

Leading gainers were led by AKD capital and EFU Life, up by Rs34.50 and 31.60, followed by National Bank, Habib Bank, MCB, EFU Life, IGI Insurance, Lakson Tobacco, BOC Pakistan, PSO, Shell Pakistan, Pakistan Services, Shezan International, and United Sugar, which posted gains ranging from Rs10.90 to 20.60.

Pakistan Engineering and Shell Gas were prominent among the losers, off by Rs17.50 and 15.65. Siemens Pakistan, KSB Pumps, Bata Pakistan, Hino Pakistan, followed them, off by Rs5.05 to 10.

Trading volume soared to 374m shares from the previous 292m shares as gainers held a strong lead over the losers at 256 with 38 shares holding on to the last levels.

The OGDC again topped the list of most actives, up by Rs4.65 at Rs129.75 on 45m shares, followed by NIB Bank, steady by 70 paisa at Rs60 on 27m shares, Bank of Punjab, up Rs4.80 at Rs101.50 on 21m shares, PTCL, higher by Rs2.05 at Rs43.15 on 19m shares, Arif Habib Securities, up by Rs2.20 at Rs178.60 also on 18m shares, Pakistan Petroleum, higher by Rs8.65 at Rs263.75 on 17m shares, and National Bank, up by Rs12.15 at Rs255.25 also on 17m shares.

Other actives included Lucky Cement, higher by Rs4.75 at Rs126.35 on 16m shares, Nishat Mills, up Rs2.10 at Rs103.10 on 12m shares and D.G. Khan Cement, higher by Rs4.70 at Rs102.20 on 10m shares.

FORWARD COUNTER: OGDC also led the list of actives on the cleared list, up by Rs4.95 at Rs130 on 8m shares followed by Bank of Punjab, higher by Rs4.85 at Rs101.85 on 5m shares and MCB Bank, sharply higher by Rs19.35 at Rs422.55 also on 5m shares.

Lucky Cement followed them, higher by Rs3.55 at Rs126.25 on 4m shares and PTCL, up by Rs2 at Rs43.20 also on 4m shares.

DEFAULTER COS: Active trading was witnessed on this counter as investors covered positions at the lower levels in most of the actives under the lead of Zeal-Pak Cement, up 15 paisa at Rs4.60 on 0.901m shares followed by Japan Power, higher by 35 paisa at Rs7.45 on 0.782m shares and Unity Modaraba, up 25 paisa at Rs1.70 on 0.700m shares.

Pangrio Sugar, followed them, lower by 50 paisa at Rs16.45 on 0.236m shares, and Invest Capital Bank, steady by five paisa at Rs5.40 on 0.139m shares.

DIVIDEND: Kot Addu Power, interim cash 32.50 per cent, Biafo Industries, interim 10 per cent, PICIC Investment Fund, interim 7.5 per cent, and PICIC Growth Fund, interim 15 per cent.

Dear visitor, the comments section is undergoing an overhaul and will return soon.