KARACHI, Feb 21: The Karachi Stock Exchange 100-share index on Thursday briefly breached through the psychological barrier of 15,000 points, up 142.39 points on strong buying, but failed to sustain it on late profit selling in some of the leading base shares amid brisk trading as turnover figure soared to current year’s record level of about 400 million shares.

Literally, bulls seemed to have ignored the talk of a possible standoff between the president and the victors on the issue of transfer of power or confrontation on ‘quit Musharraf’ demand, said a leading broker.

Higher cash dividend and bonus shares by Bank Al-Habib, at 15 per cent, 30 per cent and cash 15 per cent, plus bonus shares of 35 per cent by Askari Bank, respectively, were other supporting factors behind the market run-up, he added.

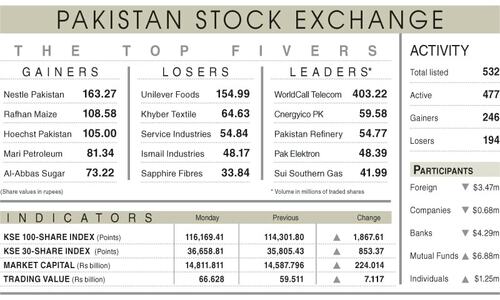

The index touched its career-best level so far at 15,035.11 points, up by 142.39 points at 14,971.97 from the overnight close of 14,829.58 as buying euphoria in oil and bank shares further intensified despite not so encouraging news from the political front as far as formation of the government is concerned.

The KSE 30-share index also rose by 174.48 points to close at a record high of 18,263.39 points.

Arif Habib Securities, National Bank, OGDC, MCB Bank and some others were among the major contributors to its meteoric rise during the post-election trading week.

The index, during the last about six weeks, recovered about 1,700 points or about 11 per cent, as it is now ruling well above the pre-Benazir Bhutto assassination level in late December last year.

The market capital soared to Rs4.606 trillion or $74 billion, a record level hit so far in the trading history of the KSE.

“Instances of strong presence of foreign fund buying are not wanting,” said a leading analyst, adding “their presence lends credence to a loud whispering that the transfer of power may be smooth.”

The perception of confrontation between the president the winning political parties may fade despite the rigid positions taken by some of them on the issue of restoration of judges and quit Musharraf demand, they said. But some others said the possibility of a standoff between the president and some of the winners is there as both have taken a rigid stand on the issue of judges and the resignation, and investors should play safe and should not ride the current wave of optimism.

Among the top gainers, Siemens Pakistan and Unilever Pakistan Foods were leading, up by Rs69.90 and 69, followed by MCB Bank, National Bank, Central Insurance, IGI Insurance, Shell Pakistan, Berger Paints, Tri-Pack Films, Pakistan Services, United Sugar, JS & Co, Adamjee Insurance, and AKD Capital, which posted gains, ranging from Rs6.75 to 38. Nestle Pakistan and Rafhan Maize were prominent among the losers, off by Rs80 and 49. Other prominent losers included EFU General Insurance, Dawood Lawrence, National Foods, Shell Gas and EFU Life, off by Rs5 to 14.65.

Trading volume rose to 398m shares, about year’s high as compared to 359 a day earlier as gainers held a comfortable lead over losers at 198 to 147, with 44 shares holding on to the last levels.

Askari Bank led the list of actives, steady by 40 paisa at Rs103.75 on 37m shares, followed by Arif Habib Securities, up Rs4.30 at Rs186.50 on 31m shares, National Bank, higher by Rs7.15 at Rs266.80 on 27m shares, OGDC up by Rs1.60 at Rs129.70 on 26m shares, Hub-Power, firm by 30 paisa at Rs33.25 on 19m shares.

D G Khan Cement followed them, higher by Rs3.95 at Rs106.45 on 18m shares, Arif Habib Bank, steady by Rs1.40 at Rs29.50 on 17m shares, Lucky Cement, up Rs1.25 at Rs128.80 on 12m shares and Bosicor Pakistan, firm by 20 paisa at Rs20.95 on 11m shares.FORWARD COUNTER: MCB Bank led the list of actives on the cleared list, sharply higher by Rs9.45 at Rs450.10 on 9m shares, National Bank, up by Rs6.90 at Rs267.00 on 8m shares, and Askari Bank, firm by 60 paisa at Rs104.10 on 6m shares.

The OGDC followed them, up Rs1.40 at Rs130 on 5m shares and D G Khan Cement, higher by Rs4.25 at Rs106.70 on 4m shares.

DEFAULTER COs: Norrie Textiles came in for active selling at the overnight higher rates and fell by 10 paisa at Rs2.20 on 0.873m shares, followed by Zeal Pak Cement, unchanged at Rs4.50 on 0.400m shares, and Unity Modaraba, easy by 15 paisa at Rs1.35 on 0.336m shares.

Japan Power lower by 20 paisa at Rs7 on 0.228m shares and Invest Capital bank, higher by 40 paisa at Rs5.80 on 0.179m shares.

DIVIDEND: Pakistan Tobacco, final cash 39 per cent and Pakistan Cement, nil.

Dear visitor, the comments section is undergoing an overhaul and will return soon.