With political atmosphere still clouded with uncertainties, international oil and gold prices touching record highs and the country’s weak economic indicators deteriorating further, mounting demand for dollars and euros in the local currency market continued to exert downward pressure on the rupee throughout this week.

With political atmosphere still clouded with uncertainties, international oil and gold prices touching record highs and the country’s weak economic indicators deteriorating further, mounting demand for dollars and euros in the local currency market continued to exert downward pressure on the rupee throughout this week.

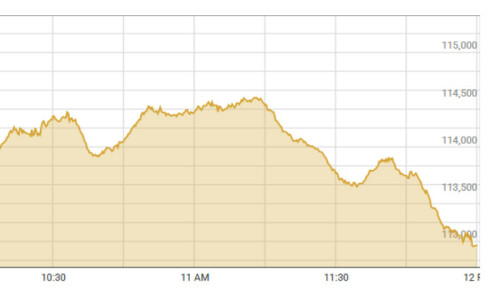

The rupee commenced the week on a negative note as its week-end weakness against the dollar persisted in the interbank market on March 3, where it shed 10 paisa over the previous week close of Rs 62.60 and Rs 62.62 and traded at Rs 62.70 and Rs 62.73 due to continued high demand for dollars by the importers.

The American currency continued its rise versus Pak rupee on the second consecutive day, as the rupee lost 12 paisa more on March 4, when the dollar was seen changing hands at Rs 62.82 and Rs 62.85 . On March 5, the rupee-dollar parity rates moved down further as demand for dollar continued to exert downward pressure on the rupee. The rupee shed three paisa on the buying counter and two paisa on the selling counter, changing hands versus the dollar at Rs 62.85 and Rs 62.87.

However, the rupee managed to stage a turn around on the fourth trading day for the first time this week, recovering five paisa to trade against the dollar at Rs 62.80 and Rs 62.82 on March 6. On March 7, the rupee managed to hold its overnight firmness versus the American currency and posted a fresh gain of 20 paisa on improved inflows of dollars amid persistent demand. At close it was seen changing hands at Rs 62.60 and Rs 62.62 against the dollar. As a result of some improvement in rupee value in the last two days, the rupee revert to its previous week close levels against the dollar in the inter bank market on the last trading day of the week in review.

In the open market, the rupee traded at Rs 62.75 and Rs 62.85, amid high dollar demand on the opening day of the week, down 20 paisa from last week close of Rs 62.55 and Rs 62.65. The rupee lost another 35 paisa on the second trading day with dollar trading at Rs 62.85 and Rs 62.95. However on the third trading day, the rupee managed to stage a modest recovery on improved inflows of dollars, gaining five paisa at Rs 62.80 and Rs 62.90.

The modest recovery in the rupee/dollar parity on March 6 proved short lived as the rupee failed to retain its overnight firmness versus the dollar and suffered fresh losses of ten paisa to touch new lows on the fourth trading day, changing hands against the dollar at Rs 62.90 and Rs 63.00, amid tight dollar supplies. On March 7, however, the rupee managed to stage a turnaround, gaining 10 paisa against dollar to trade at Rs 62.80 and Rs 62.90. As a result, the rupee in the open market was able to restrict its losses versus the dollar to 35 paisa during this week.

Versus the European single common currency, the rupee continued its falling trend and crossed Rs 94 barrier on the opening day of the week in review, losing 50 paisa to trade at Rs 94.80 and Rs 94.90 against last week close of Rs 94.30 and Rs 94.40. On the second day of trading the rupee touched new lows after shedding another 10 paisa against the euro, which was seen trading at Rs 94.90 and Rs 95.00 at close.

The rupee continued its slide on the third day and shed five paisa more to trade at Rs 94.96 and Rs 95.05. On the fourth day, the rupee suffered sharp losses versus the euro and shed 55 paisa in a single day trading at Rs 95.50 and Rs 95.60. Finally, it closed the week surpassing Rs 96 barrier versus euro, down 60 paisa at Rs 96.10 and Rs 96.20, on the fifth trading day. During this week, the rupee suffered a cumulative loss of 180 paisa against the European single common currency.

In the international financial markets, the dollar halted a sharp sell-off against the euro and a basket of major currencies on the week’s opening day as US manufacturing had not deteriorated as much as expected. Analysts said, however, it was unlikely the greenback’s recovery would be sustained given a raft of economic data this week that could reinforce fears of a US recession and a steeper Federal Reserve interest rate cut this month.

In New York, the euro traded just a tad higher at $1.5199 March 3. The dollar cut some losses against the yen to trade around 103.10 yen, down 0.6 percent on the day. Rising risk aversion following a drop in global stocks had earlier pushed the dollar to a three-year low of 102.62 yen. Sterling moved into positive territory against a broadly weak dollar after British manufacturers raised prices at the fastest rate on record, making it tougher for the MPC to make the case for interest rate cuts. Sterling was steady at $1.9865.

On March 4, the US dollar was lower against a basket of currencies for the sixth day as Federal Reserve Chairman gave a grim assessment of the US housing sector, adding to mounting fears of recession. Still, the US currency staged a late session rebound versus the Japanese yen after US stocks pared some of their sharp losses. In New York, the dollar was little changed at 103.26 yen, after it touched a session low of 102.66, near a three-year trough reached on March 3. Analysts reckon the dollar could fall as low as 100 yen, a level last breached in late 1995.

The euro was flat at $1.5205, off the $1.5275 all-time high set on the week’s opening day, according to Reuters data. Analysts said the euro’s retreat against the dollar was likely temporary, with the ECB likely to remain focused on inflation and US economic data most likely to disappoint. The US dollar surged 0.5 percent to C$0.9945 after the Bank of Canada cut interest rates by 50 basis points.

Against the Swiss currency, the dollar declined 0.4 percent to 1.0381 Swiss francs. Sterling was up 0.15 percent at $1.9875.

On March 5, the dollar resumed its slide and fell to record lows against the euro amid growing pessimism over the US economy. Demand for the currency fell further after data showed the country’s service sector contracted for a second straight month in February. The US Treasury Secretary told policy-makers that while the economy would likely continue to grow, risks were to the downside, adding to mounting fears of an economic recession. These comments were not particularly constructive.

The euro jumped to a historic peak of $1.5302 against the dollar. It was last trading at $1.5265, up 0.4 percent on the day. News that the US services sector contracted at a slower pace in February boosted investors’ appetite for risky assets such as stocks and high-yielding currencies at the expense of the low-yielding Japanese yen and Swiss currency. Against the yen, the dollar climbed to session peaks of 104.18 as US stocks rebounded from previous day’s losses. It was last trading up 0.5 percent at 103.83 yen. The pound fell to a one-week low against the dollar of $1.9723, before recovering to $1.9836.

On March 6, the US dollar tumbled to record lows against the euro and the Swiss franc after the European Central Bank downplayed prospects of an interest rate cut and did not voice concerns about the rally in the euro. News that US home foreclosures rose to record highs in the fourth quarter also added to bearish investor sentiment towards the greenback, helping to push the dollar to historic troughs versus a basket of currencies and the Swiss franc.

According to Reuters data, the euro jumped to $1.5380, its highest level since its launch in 1999 in late New York trading. It was last trading at $1.5377, up 0.7 percent on the day. The dollar declined 1.4 percent to a session low of 102.57 yen and it dropped to a record low against the Swiss franc at 1.0227. In London, sterling rose above $2 for the first time this year after the Bank of England left interest rates on hold at 5.25 percent, disappointing minority expectations for a cut. It was up 0.7 percent at $2.0066, at levels not seen since late December.

At the close of the week on March 7, the dollar slid to a record low against the euro and Swiss franc. It also hit a record low against a basket of major currencies and a three-year low against the yen. The dollar struck a new three-year low of 102.45 yen, but as some traders covered short positions it got a lift to 102.60 yen.

The dollar hit a record low against the Swiss franc at 1.0210. Sterling hit its strongest since mid December versus a struggling dollar, rising well above the $2 mark. The pound had reached $2.0216, its highest in nearly three months. It has gained more than 4 percent against the dollar in the last three weeks.

Dear visitor, the comments section is undergoing an overhaul and will return soon.