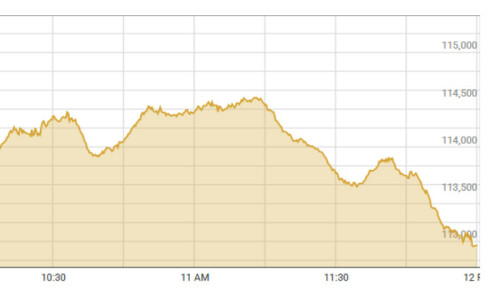

KARACHI, March 19: Stocks on Wednesday staged a broad rally boosted by heavy buying in the oil sector followed by reports of new oil finds and on other blue chip counters, notably cement at the overnight lower levels. The KSE 100-share index recovered 238 points or 1.62 per cent of the overnight loss.But some analysts attributed the rebound partly in response to recovery on the international bourses and partly to advent of strong foreign buying on the oil counter under the lead of OGDC, Pakistan Petroleum and Pakistan Oilfields and some other blue chips amid price flare-up.

A leading analyst Ahsan Mehanti, however, said oil shares received a major boost aided by news of new oil finds and instances of foreign support were lacking.

The KSE 100-share index though ended below the session’s peak level of 14,987.90, only 12 points short of the barrier at 14,964.42, up 237.88 points as compared to 14,726.54 a day earlier, and reflected investor appetite for more scrips at the current levels. The KSE 30-share index was quoted higher by 343.77 points at 18,238.44 points.

It will fluctuate around 15,000 points on the higher side and slightly below for the next couple of weeks but as the basic fundamentals are positive they will add to its strength the transfer of power in the light of new economic and financial policies.Analysts said foreign investors are steadily creeping in the market as the future political outlook now appears to be not that bleak but they are not inclined to go beyond the safe havens for the time being until the new set-up is in place.

But there may not be a major upward thrust at this stage despite the fact that the recent increase in power rates will add to the production cost of the industrial sector at this stage, analyst Ashraf Zakaria predicts.

“Strange are ways of the stock traders,” said an independent analyst. “They coin reasons of their choice to cause market decline or rise.”

The market witnesses, for instance, a massive fall of say about 500 points, the very next day it will recoup it on the strength of those shares whose fall always evoke a lot of short-covering.

Bata Pakistan and Unilever Pakistan were leading among the gainers, up by Rs30.75 and Rs39. Other prominent gainers were led by National Bank, Arif Habib Ltd, Pakistan Resource Co, Attock Refinery, Pakistan Petroleum, Pakistan Oilfields, AKD Global, PSO, Adamjee Insurance and EFU General, which posted gains ranging from Rs8.60 to Rs30.25.

Losses on the other hand were modest barring EFU Life and Colgate Pakistan, off Rs35.85 and Rs29, respectively. Javed Omer, Sapphire Textiles, Sapphire Fibres, Grays of Cambridge, and National Foods, followed them, off by Rs5.35 to Rs19.50.

Traded volume showed a modest rise at 251m shares as gainers held a strong lead over the losers at 204 to 116, with 37 shares holding on to the last levels.

The OGDC topped the list of actives, higher by Rs2.80 on reports of fresh oil discovery at Rs.134.80 on 25m shares followed by Lucky Cement, up by Rs2.05 at Rs137.20 on 19m shares, Pakistan Oilfields, sharply higher by Rs14.95 at Rs366.75 on 18m shares, Bank Alfalah, firm by Rs1.69 at Rs52.50 on 12m shares, D.G. Khan Cement, up by Rs2.25 at Rs108 on 11m shares, Pakistan Petroleum, higher by Rs13.15 at Rs261.25 on 10m shares and PTCL, up 20 paisa at Rs44.75 on 6m shares.

Other actives included Fauji Fertiliser Bin Qasim, up 85 paisa at Rs45.35 on 10m shares, followed by Javed Omer & Co, sharply lower by Rs5.35 at Rs102.60 on 8m shares and Arif Habib Securities, up by Rs2.75 at Rs166.25 on 7m shares.

FORWARD COUNTER: Bank of Punjab led the list of actives on the cleared list, up by Rs2.40 at Rs68.90 on 10m shares followed by MCB, sharply higher by Rs15.20 at Rs394.20 on 6m shares and Lucky Cement, up by Rs1.55 at Rs137.30 also on 6m shares.

The OGDC followed them, higher by Rs2.95 at Rs135.15 on 6m shares and Pakistan Oilfields, up by Rs1.5.50 at Rs368 also on 6m shares.

DEFAULTER COS: Trading activity on this counter was relatively slow as leading investors remained conspicuous by their absence because of coming holidays.

Norrie Textiles came in for active support and rose by 10 paisa at Rs1.75 on 1.020m shares followed by Zeal Pak Cement, lower five paisa at Rs3.90 on 0.196m shares and Invest Capital Bank, steady by five paisa at Rs5.75 on 0.154m shares.

Dear visitor, the comments section is undergoing an overhaul and will return soon.