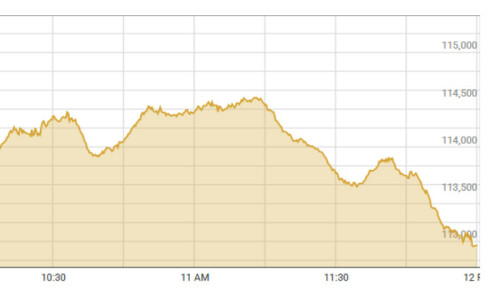

HONG KONG, March 26: Asian stocks closed mixed on Wednesday with bargain hunting continuing in some sectors but broader sentiment was again weighed down by fears over the state of the US economy.

Most benchmarks had been in a slight upswing in post-Easter trade but a weak overnight performance by Wall Street had forced many buyers out of the market.

This followed the release of US data which showed consumer confidence sinking to a five-year low in March, while home prices fell 11.4 per cent in January.

Among the best performers on the day was Sydney, up 1.2 per cent on higher commodity prices and Kuala Lumpur rose 1.3 per cent after the government made market friendly announcements.

Singapore and Wellington were little changed but Tokyo shed 0.30 per cent, Shanghai was down 0.63 per cent, Taipei fell 0.31 per cent, Mumbai shed 0.81 per cent and Bangkok was down 0.33 per cent.

TOKYO: Japanese share prices ended slightly lower as investors locked in recent gains after overnight losses on Wall Street sparked by weak economic data.

The Nikkei-225 index dropped 38.59 points to 12,706.63. Turnover fell to 1.575 billion shares from 1.905 billion shares on Tuesday.

Investors were also uncertain if the yen will stay at levels over 100 yen,” Suzuki said.

HONG KONG: Hong Kong share prices closed higher, helped by mainland Chinese financial stocks, which rose on strong profit growth and solid earnings guidance for this year.

The Hang Seng Index closed 152.49 points at 22,617.01. Turnover was 89.91 billion Hong Kong dollars (11.52 billion US dollars).

SYDNEY: Australian share prices closed up 1.2 per cent, led by gains in the resources sector following higher commodity prices overnight.

The S&P/ASX 200 closed up 63 points at 5,381.4. There were 1.3 billion shares traded, worth 5.4 billion dollars (4.9 billion US).

Base metal prices were higher on the London Metal Exchange overnight which has certainly seen the resources sector in focus, said Savanth Sebastian, an equities analyst at CommSec.

SINGAPORE: Singapore share prices closed 0.17 per cent lower as investors took profits in the absence of fresh buying leads and after the market’s recent gains.

The Straits Times Index fell 4.97 points to 2,995.22 on volume of 1.47 billion shares worth 1.57 billion Singapore dollars (1.14 billion US).

A better-than-expected annual 10 per cent rise in factory output was also not enough to whet investors’ risk appetite, dealers said.

KUALA LUMPUR: Malaysian share prices closed up 1.3 per cent after the government announced measures to boost the stock market and pledged to proceed with major development projects, dealers said.

The composite index closed up 15.47 points at 1,245.42.

WELLINGTON: New Zealand share prices gave away early gains to close 0.14 per cent lower Wednesday amid continuing volatility in world markets.

The NZX-50 gross index fell 4.83 points to close at 3,425.45 on turnover worth 90.2 million dollars (72.6 million US).

It was disappointing in the sense that it was higher earlier on, ASB Securities advisory head Stephen Wright said, after the index had gained 17 points early in the session.

MUMBAI: Indian share prices fell 0.81 per cent to snap four trading days of gains on fresh signs of a slowdown in US economic growth.

Dealers also said investors sold shares ahead of the expiry of the March delivery derivatives contract on Thursday.

—AFP

Dear visitor, the comments section is undergoing an overhaul and will return soon.