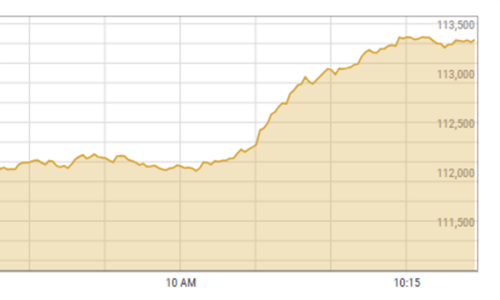

KARACHI, April 11: Stocks were back on the rails on strong local and foreign buying in leading oil shares on Friday on reports of higher production and owing to some other blue chips, which received a massive battering owing to Wednesday’s city violence.

The snap rally was led by leading energy shares, which rose in unison, partly on reports of an increase of over six per cent in local oil production and partly due to higher world prices, which are stable above $112 per barrel.

There was, however, no trace of Wednesday’s panic when trading resumed as the city limped back to normality and investors covered positions on the counters of their choice, though the market witnessed stray value adjustments here and there late in the afternoon session because of weekend considerations.

It seems the market has decided not to follow conflicting comments by political leaders on some core issues, but to go for its technical demand until there is a shock event on the political front.

The Karachi Stock Exchange (KSE) 100-share index recovered 125.97 points at 15,430.89, as leading base shares came in for active support under the lead of oil scrips and some other blue chips, including Arif Habib Securities, Hub Power and some others.“The market could move lower owing to snap shocks, both political and inspired, but it appears pretty difficult to jolt it down from its current levels,” analyst Faisal A Rajabli thinks, “it is currently operating in line with positive fundamentals rather than economic worries.”

The new entrants in the share business, both from the industry and the real estate, having massive funds at their disposal are keeping the market in a good shape and for good reasons too, he said.

Analyst Ashraf Zakaria, supporting his view, said another positive stimulant is the perception of higher payouts for the year ended March 31, 2008, and their pre-announcement impact on their share values.

Leading gainers included Colgate Pakistan and Nestle Pakistan, up by Rs27.80 and 75, followed by Lakson Tobacco, Mari Gas, Attock Petroleum, Pakistan Oilfields, Sanofi-Aventis, Service Industries, Clover Pakistan, Pakistan Resource Co and Pakistan Engineering, which posted gains, ranging from Rs7 to Rs27.60.Losses on the other hand were modest barring AKD Capital, and Bata Pakistan fell by Rs20 and 30 followed by Dawood Lawrence, KSB Pumps and Dadex Eternit, off by Rs5.30 to Rs7.10.

Trading volume fell to 245m shares from the previous 305m shares as gainers held a strong lead over losers at 193 to 97 with 45 shareholdings on to the last levels.

Fauji Fertiliser, Bin Qasim, topped the list of actives, steady by 10 paisa at Rs40.95 on 29m shares, followed by Pakistan Oilfields, sharply higher by Rs17.90 at Rs392.90 on 26m shares, D G Khan Cement, off 15 paisa at Rs117.90 on 12m shares, Pakistan Petroleum, up by Rs3.75 at Rs266.50 on 8m shares, and Hub-Power, higher by Rs1.15 at Rs32.90 on 11m shares.

Arif Habib Securities, which has been under pressure for the last couple of sessions, also recovered from the previous lows and was quoted higher by Rs4.35 at Rs182.35 on 11m shares, Nishat Mills, off Rs2.70 at Rs127 on 10m shares, Norrie Textiles, which shifted from the defaulters’ list up 60 paisa at Rs4.20 on 9m shares, Lucky Cement, lower 70 paisa at Rs144.25 on 7m shares and Sui Northern Gas, up 60 paisa at Rs69.50 also on 7m shares.

FORWARD COUNTER: Pakistan Oilfields led the list of actives on the cleared list and was quoted higher by Rs16.90 at Rs393.35 on 10m shares, followed by OGDC, up by Rs1.95 at Rs138.40 on 8m shares, and D G Khan Cement, lower by Rs1.10 at Rs116.90 on 5m shares.

Other actives were led by Fauji Fertiliser, Bin Qasim, steady by 20 paisa at Rs41.20 on 5m shares and Nishat Mills, off Rs2.45 at Rs127.50 on 4m shares.

DEFAULTER COs: Japan Power came in for active selling at the weekend session and led the list of actives on this counter, lower by 35 paisa at Rs6.90 on 2.509m shares, followed by Zeal Pak Cement, easy 10 paisa at Rs3.90 on 0.450m shares and National Asset Leasing, unchanged at 85 paisa on 0.279m shares.

Unity Modaraba followed them, up 20 paisa at Rs1.30 on 0.261m shares and Nazir Cotton, up 25 paisa at Rs1.60 on 0.128m shares.

Dear visitor, the comments section is undergoing an overhaul and will return soon.