Signals emanating from the economy lend weightage to cries from some quarters that the country has already arrived in a worrisome and difficult zone called stagflation by the economists. It is a state when the economic growth becomes stagnant and high inflation more stubborn.

Signals emanating from the economy lend weightage to cries from some quarters that the country has already arrived in a worrisome and difficult zone called stagflation by the economists. It is a state when the economic growth becomes stagnant and high inflation more stubborn.

While the economic growth has declined from the targeted 7.2 per cent to close to 5.8 per cent, the unabated double-digit inflation continues to haunt the policy makers. Critics say that the tightening of the monetary policy may not tame inflation in the short-term but may retard economic growth.

The business sentiments about investment prospects seem to be creating a negative effect in the economy. The high cost of doing business and depressed demand in export markets are not Pakistan-specific. However, Asian economies including those of China and India driven by better growth models have so far not shown signs of any major dent in their growth momentum.

Over the last five years, the economy despite all its severe problems like weak institutional and physical infrastructure and growing imbalances has also been posting six to seven per cent growth. The share of agriculture in GDP has declined and manufacturing growth has been slower as compared to the expansion in the services sector.

There are two questions that need to be asked before moving on towards a strategy to break out of this situation of slowing economic growth and high inflation. One: what has exactly changed for the engine of growth that has been services sector? Two: is the business sentiment all-pervasive or limited to big business, multinationals or big mercantile groups?

“Nothing worth mentioning has changed for the services sector. The situation has become more challenging for the manufacturing amidst growing uncertainty and rising costs” Khawaja Shahab, federal secretary ministry of industries told Dawn over phone from Islamabad. The secretary agreed that the political government should consider out of box options to deal with the challenges on the economic front.

“In my view, the suggestion to evolve a business-led team comprising the nominees of coalition partners for full five-year term should be considered seriously. This is very much possible and could lend stability and revive investor’s confidence in the economy. All you need is a political will to address the challenges without politicising the economic decision-making process”, he said.

An analyst, however, saw nervousness engineered by principal beneficiaries of the last regime who have yet to develop dependable links in the new set-up. “Everyone knows that the government needs to generate more resources. They are creating noises to pressurise the government to design the budget in a way that does not hurt them in any way”, he said on promise of anonymity.

“Big business is weary of expanding scope of military enterprise but because of its dominant positioning it co-opted in a working relationship with it. The announcement by the government that it is considering to increase duties on certain luxury items has infuriated the trading lobby that might not be able to sell same volumes of imports at increased rates in the domestic market when the level of value of disposable income is shrinking,” he said.

A report on the economy produced by reputable economists, many of them with a World Bank background, did not get the attention it deserved.

The report-a publication of the Institute of Public Policy- ‘State of economy: challenges and opportunities’, in a systematic manner reflects in the words of its chairman Shahid Javed Burki, “all three sets of issues: sustainability and inclusiveness of growth; institutional development; decentralisation; short-run macroeconomic adjustment to bring down inflation; and the twin budget and current account deficits”.

The main contributors of the report include; Sartaj Aziz, Shahid Javed Burki, Aisha Ghaus Pasha, Pervez Hasan, Akmal Hussain and Hafiz Pasha.

“Things are still in the making”, Farrukh Qayum, federal secretary finance told Dawn when his opinion about the reason of the government weak response to the economic challenge was solicited.

He hoped that the growth rate will be six per cent for the current year despite the problems that the country confronted over the last one year. “We are hoping to settle all outstanding liabilities and start the next fiscal afresh”, he told Dawn.

The finance secretary further observed: “The flow of remittances is good. There are favourable symptoms of fresh flow of foreign direct investment in a number of sectors. So the situation is not as bad as some rent seeking elements made it out to be. Let the stability return and private investor will hopefully step in to capitalise on huge business opportunities”.

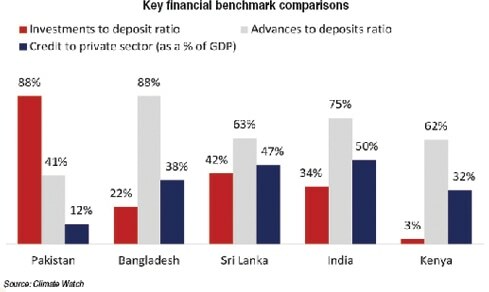

All said, the biggest challenge is to divert the liquidity towards productive avenues so as to fight recessionary and inflationary trends.

Dear visitor, the comments section is undergoing an overhaul and will return soon.