All the four provinces now want the federal government to give up levying and collecting sales tax on services. After a joint meeting of all provincial ministers at Lahore, the Punjab Finance Minister, Mr Tanvir Ahmad Kaira told at a press conference on Wednesday “we have decided to recommend to the federal government to transfer the right of sales tax collection on services to the provinces”.

All the four provinces now want the federal government to give up levying and collecting sales tax on services. After a joint meeting of all provincial ministers at Lahore, the Punjab Finance Minister, Mr Tanvir Ahmad Kaira told at a press conference on Wednesday “we have decided to recommend to the federal government to transfer the right of sales tax collection on services to the provinces”.

The provinces are also seeking devolution of development and planning responsibilities and management. Soon, the provincial ministers are expected to see federal government leaders and to plead for transfer of all those development schemes which are included in the Public Sector Development Programme but pertain to their respective jurisdictions. “It is the first candid and forceful articulation of fiscal autonomy by all the provinces unanimously’’, an official in Sindh government remarked. He recalled that Sindh was the first and perhaps only province to protest in the year 2000 when federal government made a move to levy and collect sales tax on services ‘’in mould of central excise’’ to circumvent the Constitution.

The Constitution provides in clear terms the federal government’s right to collect sales tax on imports, exports, domestic production and consumption of goods, but explicitly excludes services from the jurisdiction of federal government.

‘’The federal government has been levying sales tax on services in violation of the provision of the Constitution,’’ an official letter of Sindh government said in October 2005 demanding that all collections made by Islamabad from sales tax on services, ‘’be paid back to the provinces on the basis of collection and not on population basis’’.

“It is also proposed that the estimated revenue of Rs3.10 billion for the year 2005-06 including the arrears with effect from the year need to be paid to the provinces on collection basis,’’ the Sindh government had demanded.

Since the year 2000, the federal government had been collecting sales tax on telephone calls, gas distribution, electricity, air travels and on railways. Later, the federal government extended the net to collect sales tax on behalf of the provinces on restaurants, hotels, clubs, slimming clubs, radio and television advertisements.

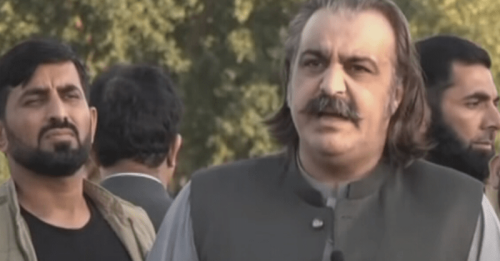

“The Central Board of Revenue (now the Federal Board of Revenue) never gave details and break down of collection of all these sales taxes on various services to let the provinces know how much is being collected from where and from which source,’’ Syed Sardar Ahmad, former finance minister Sindh disclosed.

‘’Once given the responsibility, the provincial tax collectors will have the capacity to assess prudently and recover sales tax on different services,’’ he said and explained the immense potential it has for revenue generation.

With almost 54 per cent share in the national economy, services sector offers immense potential to Sindh and Punjab for revenue generation. Privatisation, expansion of financial services, innovations in information technology, fast growing health services, expected changes in agriculture and agro-based productions are all areas of potential revenue generation for the provinces.

It is not only sales tax on services but the very concept of general sales tax that is being questioned by the provinces. Almost all over Western democracies-USA, Canada, federations in Europe, union governments and Australia, sales tax is assessed and collected by the federal or union constituents. In the neighbouring India, sales tax is collected by the federating states and not by the union government.

In Pakistan, the sales tax is being collected by the federal government and distributed among the federation and provinces on the basis of population.

‘’Now that expansion in economy, particularly the services sector in Punjab is on a fast track, the distribution of sales tax on collection basis will benefit Lahore most in near future’’, a business leader of Karachi Chamber of Commerce and Industry said. “With Punjab emerging as a future hub of trade and economic activities, the government in Lahore will be richest in terms of revenue generation,’’ he anticipated.

Many business leaders are happy to note a change in attitude of the politicians in Punjab who now feel close to the aspirations of the people of other provinces. Resources distribution remained a thorny issue between Punjab and other provinces. Now, Punjab has taken an initiative and joined other provinces in assertion of provincial rights.

In the Wednesday meeting, the political leaders of all four provinces also decided with one voice to raise the NWFP issue of recovery of Rs159 billion hydro royalty issue and Balochistan’s demand for Rs248 billion gas royalty, with Islamabad.

With a running overdraft of Rs19 billion with the State Bank of Pakistan and a huge budget deficit Balochistan needs extra financial care to come out of woods and embark on a meaningful path. Balochistan wants its overdraft be converted into a loan payable over a long period. It further wants that its immense size and backwardness be given a special consideration in resources allocation in the future National Finance Commission award.

‘’The federal finance minister may convene the meeting of the seventh national finance commission suo moto or on the requisition of any provincial finance minister’’ Syed Sardar Ahmad advised Sindh Chief Minister Syed Qaim Ali Shah in a recent letter. As he contends, the seventh NFC stands constituted vide President’s Order of July 21, 2005 issued article 160. It is still in force and will cease to exist on July 20, 2010.

But Syed Sardar Ahmad considers the present structure of NFC defined in 1973 Constitution as totally out of tune with the times and needs which will never be able to reach a consensus. The federation and all provinces are too eager to secure a share from the tax resources and are therefore unable to reconcile diverse interests. Sardar prefers the structure of Indian NFC.

In India, the president nominates a person of eminence either from judiciary, administration or academics as a chairman along with four other reputable members of the NFC. This NFC is for five years with its independent secretariat. For two years, this NFC meets all stake holders of the constituent states-politicians in government, opposition, independents, trade unions, academics and others. It then compiles its recommendations for distribution of resources between the union and the states and among the constituent states on the criteria it sets in light of its interaction with stakeholders.

The Wednesday meeting did not discuss the NFC Award as it was ‘’too complicated’’. But it is bound to come up after the presentation of budget.

Dear visitor, the comments section is undergoing an overhaul and will return soon.