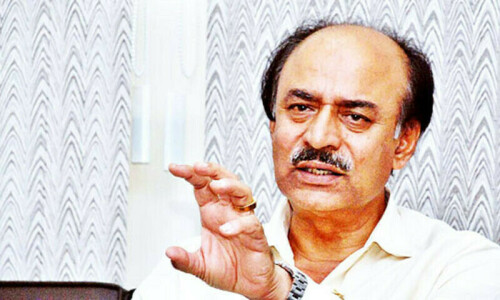

KARACHI, Aug 16: The government expects about $3.5 billion foreign exchange inflow by end of this month, while a strategy to tackle inflation and ease pressure on the rupee will be announced in the next few weeks, said Federal Minister for Finance Naveed Qamar on Saturday.

In reply to questions of the journalists at a press briefing after holding over two-hour long meeting with the members of All Pakistan Textile Mills Association (Aptma), the minister said that the government was floating a bond in international capital market against remittances.

“There are expectations of $1 billion flow from the World Bank and other international financial institutions plus foreign funds are also expected from some other sources,” the minister elaborated.

Responding to a question that textile mills had complained of getting stuck up in currency swapping of their loans under a State Bank of Pakistan policy directive, the minister said initial reports suggested quite a few banks might have violated prudential rules and the matter was being investigated.

Answering another question, the minister said that the next meeting of the Economic Coordination Committee (ECC) of the Cabinet would take up the issue of research and development subsidy support on textile products export.

“The government has given an assurance to give 6 per cent subsidy support on export of garments and apparels and will consider offering assistance to other sectors,” he added.

The textile industry leaders want the continuation of this subsidy support for bedwear, made-ups and processed fabrics and on local sale of polyester fibre but also want to extend it to spinning and weaving.

“This will not only revive the ailing spinning and weaving industry but will also assist the value added sector to price their products more competitively in international market,” argued an Aptma leader.

A journalist drew the minister’s attention towards the State Bank of Pakistan Governor’s monetary policy statement in which the present government had been held responsible to have borrowed highest amount from banking system in 2007-08.

“It was because, the previous government had concealed Rs100 billion borrowing from oil marketing companies, the minister said to explain that spike in government borrowing came from shifting of account entry from oil companies’ books to the government.”

But he was confident of bringing down government’s borrowing from banking system to a manageable level in the current fiscal year.

He however did not agree with a questioner that after the international prices have started coming down to $113 a barrel level, the government should consider passing on this price reduction to consumers.

“Iran is an oil producing country where diesel from Pakistan is being smuggled,” he tried to explain that subsidy driven reduction in oil prices encourages smuggling to Iran and Afghanistan.

Earlier an ugly scene was created when the journalists who were invited by Aptma to cover this meeting were rudely asked to leave the committee room. They were told a press release would be dispatched to their offices after the consultations were over with the minister.

There was strong protest and Aptma leaders and the minister were reminded that journalists have turned up in response to an invitation.

“We will give you a briefing after the meeting, Aptma Chairman Iqbal Ibrahim promised on minister’s behalf which was done accordingly.

The Aptma members in the meeting expressed their concerns about further worsening of inflation, more pressure on rupee exchange value and depletion in foreign exchange reserves in coming days.

They advised the minister that the government should curtail oil consumption by way of rationing or closing down of pumps besides drawing up a short-term strategy to “tackle worst economic crisis”.

“It is a global recession that has hit us and we are ready to share with government the responsibility to tackle this crisis,” the Aptma chairman informed waiting journalists.

“Recently, the parity of US dollar against the rupee has gone up from Rs60 to Rs76,” the Aptma leader informed the minister to convey that the situation was unmanageable as a lot of textile mills had been hurt seriously on account of this massive devaluation.

A large number of mills had kept their position open against import order under usance letters of credit for raw material and machinery and many have entered into cross currency swap under SBP Financial Derivatives Business Regulation.

Pleading their case, the Aptma members called upon the government to give textile mills a bail out from this situation.

While the Aptma leaders estimate $1 billion stake in this cross currency business, the minister said that the State Bank of Pakistan would be having accurate figures.

The Aptma chairman informed journalists that textile industry leaders had asked the government to give top priority to inflation and help the poor and needy people. “We have suggested rationalisation of import duties on a number of items,” he said.

Most of the proposals given by Aptma to Mr Naveed Qamar carries a heavy price tag as the suggestion is for two years moratorium on loan payment, restructuring of all outstanding loans, freezing of markup payable up to June 30, 2010, relief on interest payment to spinning, concession on rate of financing for procurement of raw material.

Dear visitor, the comments section is undergoing an overhaul and will return soon.