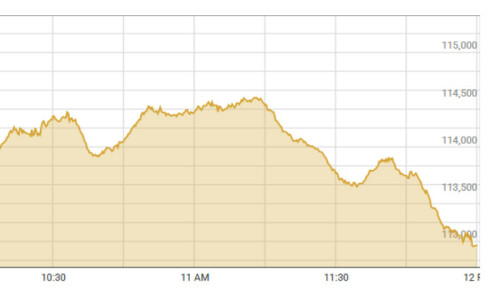

LONDON, Sept 23: Gold fell 1 per cent in Europe on Tuesday as the dollar recovered some lost ground versus the euro and investors took profits after the previous session’s gains.

But with concerns remaining about the impact of the US government’s proposed $700 bailout of the financial system, gold may be poised to trend higher, traders say.

Spot gold was at $889.90/891.90 an ounce down 1 per cent from $900.20 an ounce at the nominal New York close on Monday.

Yesterday, we had a real up day in commodities in general, whether oil or gold,” said Afshin Nabavi, head of trading at MKS Finance in Geneva.

Today, there is a bit of profit taking. We still have to wait and see what the stock markets will do in Europe and the States, he said.

But buying on dips should be the name of the game. The government’s $700 billion rescue plan for the financial sector initially cheered the markets, but pressured equities and the dollar in later trade as investors worried about its budgetary implications and doubted it would prevent recession.

The weaker dollar boosted buying interest in gold and precious metals as an alternative investment. Volatility in the equity markets also prompted investors to switch out of stocks in favour of safer assets.

While investors are taking the opportunity to book profits, bullion is likely to turn higher if the dollar fails to recover.

Despite its high volatility, gold’s safe haven qualities are clearly attractive to investors, particularly in light of expected weakness of the US dollar, Fairfax analyst John Meyer said.

Gold’s losses mirrored those of crude oil, which slipped more than $2 a barrel on Tuesday after a record one-day rise in dollar terms in the previous session. Pricier crude tends to push gold prices higher because the precious metal is often bought as a hedge against oil-led inflation. Rising oil prices also boost confidence in commodities as a whole.

Investment demand has been strong. The world’s largest gold-backed exchange-traded fund, the SPDR Gold Trust saw a 30.2-inflow on Monday that brought its gold holdings to a record 709.62 tons.

Buying for ETFs, which issue securities backed by physical bullion, represents a major source of demand for gold.

—Reuters

Dear visitor, the comments section is undergoing an overhaul and will return soon.