LONDON, Sept 29: Gold slips in Europe on Monday as expectations the US government will receive approval for a $700 million bailout of its financial sector curbed safe-haven buying, and the dollar strengthened.

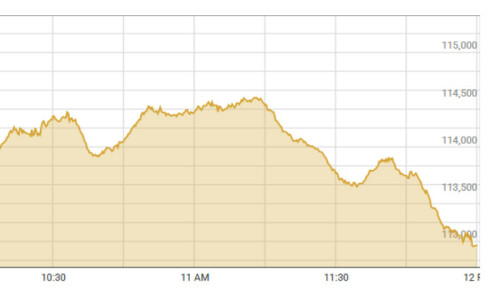

Spot gold was quoted at $873.85/875.85 down half a per cent from $878.40 at the nominal New York close on Friday.

Some of the flight to quality trade (in assets) like gold, like treasury bonds, even cash, is now being unwound, said Calyon metals analyst Robin Bhar.

There is a bit of short term relief in the market. The dominating factor is the dollar, he added.

News of a state buyout of Fortis Bank, and government intervention in ailing UK mortgage lender Bradford & Bingley, spooked the market.

The US currency has also been supported by news that the

US Congress is close to agreeing a $700 billion bailout of the financial sector.

The other main external driver of gold, the crude oil market, is also wilting, shedding more than $4 a barrel at its session low and trading just above $100 a barrel.

Oil was pressured by gains in the US dollar, which makes dollar-priced oil more expensive for holders of other currencies.

In the crude oil market, participants have realised that the rescue package would not lead to a quick recovery of consumers demand, said Dresdner Kleinwort in a note. Crude oil is trading lower again...., which is negative for gold.

Analysts said overall they see gold prices taking good support from ongoing financial uncertainty and prospects for a weaker dollar.

Gold demand from both jewellers and institutional investors is expected to be supportive, with consumption of gold jewellery, coins and bars seen picking up significantly as prices slip to and below $850 an ounce.

Demand from gold-backed exchange-traded funds is also strong.

Holdings of the world’s largest bullion-backed ETF, SPDR Gold Trust are at 724.63 tons, close to the record levels they hit last week.

Jeremy Charles, head of the LBMA and a gold trader at HSBC, told Reuters at the Kyoto conference that he expects private banks and institutional investors to buy more gold in the current climate.

Platinum was at $1,107/1,119 an ounce against $1,108 an ounce, while palladium fell more than 1 per cent to $218/224 against $221.—Reuters

Dear visitor, the comments section is undergoing an overhaul and will return soon.