Many established importers claim that they have been rendered almost bankrupt by the volatility of international commodity prices that dropped sharply between August and November 2008.

Many established importers claim that they have been rendered almost bankrupt by the volatility of international commodity prices that dropped sharply between August and November 2008.

They operate from Jodia Bazar, Liaquat Market, Motan Das Market in Karachi and in Akbari Mandi and Shah Alami in Lahore.

Similarly, many exporters of textiles, mainly of yarn, rice, cement and leather goods, could also not escape the impact of price volatility during this period. But the currency depreciation has made exports relatively cheaper in the international market and total exports during July to November 2008 went up by more than 12 per cent over the same period last fiscal.

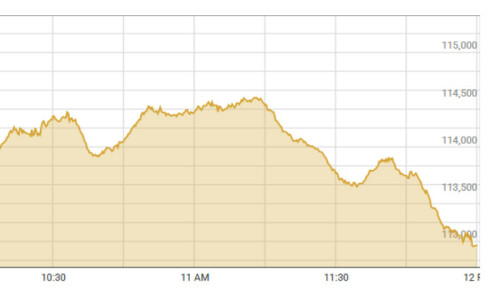

“We don’t see any chances of recovery in first quarter of 2009’’, Amjad Rafi, a business leader said. He also spoke of a quick and steep fall in prices of commodities like polymers, synthetic yarn, iron and steel, edible oil, almost one third to 50 per cent, on which letters of credits were lodged at the time of unloading at Karachi port. The annual commercial import of all these items is estimated at around $7-8 billion (Rs560-640 billion in a year). Commercial importers are also informal investors as they supply commodities on credit basis to the industry. “We can safely say, Rs2.5-3 billion have been wiped off from the account books of importers and stockists’’, an importer estimated.

“Imagine a trader booking 3,000 tons of polymers at $2,000 a ton late August from Korea or Saudi Arabia. By the time the consignment reached Karachi in the last week of September, the prices tumbled down to $1,400 a ton’’, he said. Polymers are one of the key industrial inputs being imported from Saudi Arabia, Korea and India. Pakistan imports about 0.7 million tons of polymers every year and many small and big traders are involved in its trade.

“Those who managed to survive this crisis are lucky,’’ says Javed Ilyas whose family has been doing business with China for last more than 40 years. He believes that recession that hit the world in second half of this year was “more psychological’’ in which speculators and middlemen wreaked havoc. “The real recession in coming in the year 2009’’, he fears.

With $1.9 trillion foreign exchange reserves, China is stuck up with $1.2 trillion investment in the US bonds and treasury bills. More than 32,000 industrial units have been closed down only in one province of China from where thousands of factory workers are said to have migrated back to their small farms.

China is taking up a four trillion yuan public stimulus plan and has raised rebates on exports from nine to 13 per cent. This creates hope that China may resume some of its business activities after New Year celebrations sometime in February. Pakistani businessmen are looking with some expectations at Chinese market for their products and also to get some cheap raw material at stable prices. Another significant feature is that quite a number of items on both sides will be given more tariff concessions.

In this period of extreme distress (between August to October 2008) there was not a single federal minister of commerce, textiles and industries who was found addressing these issues.

“How dismal the business scenario is, can be best understood from the fact that FPCCI export award distribution ceremony was devoid of all fanfare this year as is the tradition, ‘’ Ejaz Khokar from Sialkot said. He won a gold medal for sports wear exports.

Retired Major General Rehmat Khan, former Chairman of All Pakistan Cement Manufacturers Association revealed that 29 cement factories operate on 75 per cent production capacity because of a fall in exports and a drop in domestic consumption. He also reported a stock of about 0.4 million tons of unsold cement in some factories. The recently elected Chairman of the SITE Association of Industry, Engineer Jabbar does not see any light at the end of the tunnel after dramatic economic turndown. He thinks a constant interaction between government and businesses should be maintained as situation is fluid and new realities keep emerging in the international markets.

But there are also brave voices in this otherwise dismal environment. One such voice was that of the chief executive of a private insurance company-- the Eastern Federal Insurance. ‘’We faced many hard situations in the past and are now preparing our strategy to overcome the coming difficulties next year,’’ said Saifuddin Zoomkawala.

He recalled how difficult it was for him and his friends in the insurance business to stay afloat after the separation of East Pakistan in 1971, followed by its nationalisation. The industry faced problems in 1981 but it was on its feet again and moved ahead. “We handled Pakistan’s international trade when it was hardly $12 billion a year. Now we are giving cover to almost $60 billion international trade’’, the chief executive of yet another private general insurance company remarked.

In the year 2008, Saifuddin said, insurance industry suffered heavy investment losses because of a massive slump in stock exchange from which the market has not come out as yet. He foresees not one but many economic storms next year. “Only those who outmanoeuvre these storms will continue to move forward,’’ he added.

Syed Mohibullah Shah, Chief Executive of the Trade Development Authority of Pakistan (TDAP) is another voice of confidence. “The $22 billion export target for 2008-09 is achievable,’’ he claimed and based his optimism on more than 12 per cent export growth achieved during first five months of this year.

While conceding that the textile exports in EU and the US are under tremendous pressure because of financial crisis, he added that, “we are trying to open many small windows of opportunities’’ for our exporters. One such small window, he said, is the expiry of anti-dumping duty on bed wear import into EU. The EuroCotton has not received any complaint so far and expectations are that Pakistan’s bed wear export will not be subjected to anti- dumping duty.

Another window the government is trying to open is some space in EU’s new GSP plus scheme. The Federal Minister of Commerce Makhdoom Amin Fahim and Syed Mohibullah Shah were in Sweden in November where, according to TDAP Chief ‘’Swedish authorities were found to be sympathetic’’. Sweden is to acquire Presidency of EU next July and its support for Pakistan carries a lot of weight.

The TDAP is planning a big trade delegation to Russia next March that will explore marketing not only in its European part but also in its Asian part. The people living in Asian part are said to be much closer to cultural tastes, clothing designs and eating habits of the people in Pakistan. It will be the first time any traders’ team will be visiting Asian provinces of Russia.

An investment wing has been set up to attract the returning Pakistani investors from UAE after the Dubai bubble burst. “There is a lot of investment potential in agro-based industry, mineral production, and many more items where returning Pakistanis can play a key role’’ the TDAP Chief said.

Dear visitor, the comments section is undergoing an overhaul and will return soon.