A STRONG weekend rally triggered by the Securities Exchange Commission of Pakistan’s (SECP) clarification on new accounting standards and perception of better ties with India in the backdrop of positive probe into the Mumbai attacks allowed the share market to wipe out early week losses on active short-covering at the lower levels.

A STRONG weekend rally triggered by the Securities Exchange Commission of Pakistan’s (SECP) clarification on new accounting standards and perception of better ties with India in the backdrop of positive probe into the Mumbai attacks allowed the share market to wipe out early week losses on active short-covering at the lower levels.

Although a bit late, the SECP finally announced at the weekend session that the impairment loss would be on equity values and not on profit and loss.

This led to the return of bulls flooding the market with bystops on selected counters.

Analysts said the market could resume its recovery tempo next week as both the news were positive as far as the investors were concerned and the lower levels could attract a lot of covering purchases in coming sessions as their major inhibiting factor was removed by the SECP.

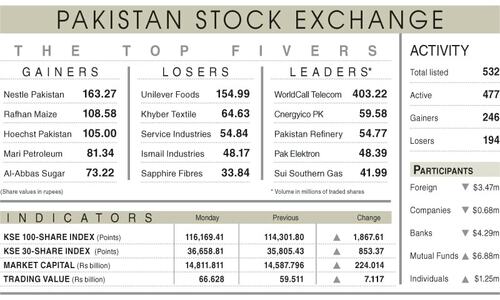

After last two weeks sustained run-up, share values earlier in the week shed extra weight as a section of investors took profits at the inflated levels amid mostly two-way activity. The KSE 100-share index was higher by 28.46 points at 5,625.90 after early weaknesses.

Analysts attributed more than one reasons behind the early interruption in the run-up aided by strong NIT-led fund and institutional buying to a number of negative factors, notably the confusion over the implementation of new accounting standards. But the chief factor among them was market’s technical demands and increasing concerns over law and order situation in FATA and suicide attacks elsewhere, they said.

Another positive development was the setting up of a committee by the SECP to review the CFS-MK-2, which will pave the way for a new product including hedging facilities on the forward counter but it came at a time when the market was in the process of guiding to exit route to weak-holders and jobbers, they added.

However, all was not bad with the broader market as some of the leading shares in the oil, auto, fertiliser and banking sectors maintained firm outlook on the strength of higher dividend and expectation of upcoming board meetings.

Stocks on Monday, therefore, sustained the late run-up boosted by strong short-covering in the MCB ahead of its scheduled board meeting, which was postponed owing to new accounting standards and market talk of higher per share earnings.

Having largest weightage in the KSE 100-share index, speculative and investment buying in it pushed it to high of 5,676.58 points, but late profit-selling in other blue chips pushed it to finish with a modest rise of 28.46 points at 5,625.9.

But despite the weakness of the National Bank, other leading bank shares and blue chips in the oil sector limited the fall in the index.

All other indexes including KSE 30-share and All Shares index also rose modestly on late recovery initiated by the oil and banking sectors followed by auto and fertiliser shares.

Final dividend announced by the leading shares in food sector, notably Unilever Pakistan, Unilever Foods and Nestle Pakistan at 114,140 and 250 per cent respectively and by Rafhan Maize, final 400 per cent were well-received by the investors, some technical factors triggered profit-selling by some leading bargain hunters.

“I don’t think the current run-up is overdone”, said a leading analyst Ahsan Mehanti adding “there are reasons to believe that the current index level well above the support level of 5,550 points indicates that the market’s winning streak could be further intensified in coming weeks”.

But he said the confusion about new accounting standards followed by divided opinions about their implementation and some bad news from political and law order fronts also triggered the selling, but each fall fuelled fresh covering purchases at the dips.

“The tension on political front owing to war of wits between the major contenders of power though are being ignored by investors for the time being on the strength of some higher interim dividend news there could be some shocks if the showdown goes beyond the control of them”, another leading analyst Faisal A. Rajabali fears.

Although the market has still to go a long way to regain its past glory, the current confidence-building steps being taken could keep it in a good mood in the coming weeks also, he said.

Strong presence of fund and institutional traders though on selected counters continue to inspire fresh short-covering by some other quarters as was reflected by large volumes, dealers said.

Forward counter: There was no change in the prevailing price pattern as there were more sellers than buyers and in the process falling process continued without any transaction.

Barring fertiliser, auto, bank and blue chips on some other counters, the general accent was on the lower side as investors still in two minds about putting money on the cleared list.

—Muhammad Aslam

Dear visitor, the comments section is undergoing an overhaul and will return soon.