ISLAMABAD, June 18: Pakistan and the International Monetary Fund (IMF) are opening on Wednesday week-long discussions on Islamabad’s latest fiscal and macroeconomic adjustments and its request for a possible $5 billion bailout package for repayment of the fund’s outstanding loans.

A senior official of the ministry of finance said the government had made a fiscal adjustment of about 2.5 per cent of GDP in its budget for 2013-14 to reduce fiscal deficit from 8.8pc to 6.3pc of GDP during the next financial year and hoped it would convince the IMF into agreeing on a new Extended Fund Facility (EFF) of about $5bn repayable in 10 years.

Pakistan’s top priority during the talks will be to secure a letter of comfort from the IMF to pave the way for resumption of programme loans by the World Bank and the Asian Development Bank held up since 2009 after suspension of the IMF programme on failed reforms.

Pakistan will also brief the IMF mission on its plans to settle over Rs503bn of energy sector circular debt before the middle of August and a roadmap to restructure the power sector and further fiscal adjustment of 1.3pc of GDP in 2014-15 and 1pc of GDP in 2015-16 to bring down fiscal deficit to about 4pc of GDP.

The official said that as part of preparations for talks with the IMF, the government has decided to avoid quarterly increases in electricity and gas tariffs — an old demand of the fund to bring energy prices to market-based tariffs by eliminating all subsidies.

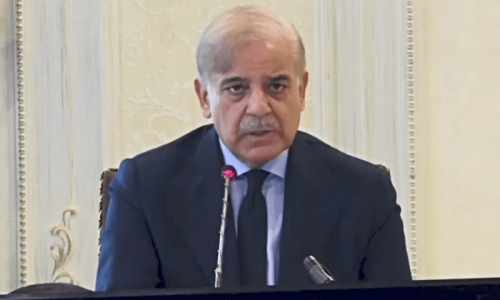

Finance Minister Ishaq Dar told journalists recently that the IMF mission would remain in Pakistan from June 19 to July 3 for substantive talks and post-programme monitoring of the existing programme but a senior official said the talks were expected to be concluded by June 26.

The two sides are required to hold biannual review of Pakistan’s economic situation as part of Post-Programme Monitoring (PPM). At the end of discussions, Pakistan is expected to make a formal request to the IMF for a new EFF programme. The mission will submit Pakistan’s request as well as its assessment report to the IMF executive board.

The official said the authorities were comfortable with foreign exchange reserves till the end of July even after repayment of about 450m special drawing rights (IMF currency) – about $675m.

However, the authorities are not comfortable about some heavy repayments due to the IMF in October-November when Pakistan has to repay 1.685m SDRs ($2.5bn) that could reduce reserves to a critical level and put pressure on exchange rate.