THE potential of the country’s engineering sector is said to be quite vast. Besides meeting indigenous needs, the industry’s annual export potential has been estimated at a billion dollars.

While a small piece of the $10trn global market pie, this would nonetheless have a healthy impact on the country’s balance of trade.

“The government should provide a level-playing field to the sector by rationalising the tariff structure by reducing duties on various raw materials and protect locally manufactured engineering products,” said the proprietor of a medium-sized engineering unit.

Last Thursday, the company said its board has decided to transfer the healthcare business to a private limited company to be incorporated in Pakistan by Siemens, subject to necessary approvals

He stressed that the government ought to ban the imports of components, parts and machinery that are already being locally manufactured. The Engineering Development Board (EDB), under the industries ministry, is the apex government body that has been entrusted with strengthening the engineering base.

“Pakistan has great capabilities in various sectors of engineering, such as electrical, agricultural, heavy engineering and automobile parts,” asserted Mohammad Sami, a former member on the EDB Board, while speaking on the phone from Islamabad.

One of the oldest engineering companies in the country is Siemens Pakistan, which was incorporated in 1953. “In order to take full advantage of the market potential in the fields of electrification, automation and digitalisation, Siemens’ businesses are bundled into nine divisions. And healthcare is a separately managed business,” said a company official.

The company’s various divisions include power and gas, wind and renewable power, power generation services, energy management, mobility, digital factory, process industries and drive, and healthcare, among other activities.

In their report for the six months ending March 31, the company’s directors said the firm received new orders worth Rs3.35bn in the period. Of this, a major chunk of orders came for the energy management division (44pc), followed by process industries and drives (21pc), digital factory (14pc) and power and gas (11pc).

Siemens Pakistan is engaged in right sizing and restructuring. It closed down the diesel generating set and locally manufactured non-standard motor businesses and then disposed off the transformer business, which many thought was the company’s mainstay.

And last Thursday, the company said in a stock exchange filing that its board has decided to transfer the healthcare business at fair market value to a private limited company to be incorporated in Pakistan by Siemens, subject to necessary approvals. It added that effective December 31, it would cease to participate in further business in Afghanistan due to the withdrawal of sales rights by Siemens AG for that country.

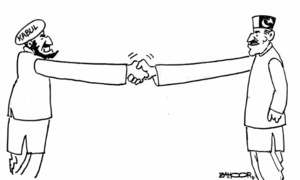

On the same day, K-Electric announced that it had signed contracts worth $400m with Siemens (Germany and Pakistan) and Shanghai Electric (China) for the execution of a major package to enhance its transmission capacity and improve the reliability and the stability of its transmission infrastructure.

Siemens Pakistan has a paid-up capital of Rs82.5m in the form of 8.24m shares of par value of Rs10. The Senate Standing Committee on Finance last Wednesday approved the amendments proposed by the SECP to Section 95-A of the Companies Ordinance, allowing listed companies to purchase their own shares and hold them as treasury shares.

It was only a couple of years ago that Siemens Pakistan had repurchased $8.47m worth of its own shares. Market players had speculated at the time that following the footprints of Unilver Pakistan, the engineering giant may be preparing to quit the stock exchange as well. That, however, did not come to pass. Siemens still has a strong presence on the KSE’s engineering sector.

The company has a strong balance sheet, with Rs3bn in reserves. Its total assets stood at Rs13.3bn by end-March. Nonetheless, the company posted a loss of Rs66m for the nine months ending June 30, against an after-tax profit of Rs180m for the corresponding period of the previous year. The red did not come as a surprise to the market, as the company had already issued a ‘profit warning’ of depressed results. Its net sales for the period amounted to Rs6.7bn, down from Rs7.4bn last year. Energy management was a major contributor of 60pc to overall sales during the nine months.

At the operating level, the company earned a profit of Rs175m, down from Rs537m in the corresponding period of the previous year. Its three major expenditure items were marketing and selling expenses (Rs291m), general and administrative expenses (Rs135m) and financial charges (Rs151m). In a low interest rate scenario, analysts said the company might be comfortable with financing its debts by the end of the year.

The company has yet to issue its directors’ report for the latest period. In his half-yearly report to shareholders, the CEO, Guenter Zwickl, had mentioned that the company was focusing on its core business. And he had also added a caveat: “The future success of the company is to a great extent dependent on the positive development in micro and macroeconomic indicators as well as the law and order situation in the country”.

Published in Dawn, Economic & Business, August 3rd, 2015

On a mobile phone? Get the Dawn Mobile App: Apple Store | Google Play