KARACHI: Cement makers anticipate further increase in their production cost after restoration of Gas Infrastructure Development Cess (GIDC).

Farhan Mehmood of Sherman Securities expects an increase by Rs10-12 per cement bag by the companies having gas-fed captive power plants (mainly D G Khan, Lucky, Maple Leaf etc).

The plants which mainly consume electricity from national grid (Kohat, Larfage, Pioneer, Fecto etc), will be the major beneficiary as their production cost may remain unchanged.

He said the government has already revised GIDC on captive plants from Rs50 per mmbtu to Rs100.

The tax was initially levied on industrial consumers and captive power plants in July 2012. However, a stay was granted by the Peshawar High Court which was vacated by Supreme Court recently.

In a statement, a spokesman for All-Pakistan Cement Manufacturers Association (APCMA) said that the cost of production rapidly increased in the last few months due to increase in transportation cost, rise in electricity tariff, labour charges, hike in interest rates, rupee devaluation and increase in gas prices.

In addition, cement industry has been brought within the purview of ‘3rd Schedule’ of Sales Tax Act 1990 in 2013-2014 Budget which raised an overall tax burden, resulting in price hike.

He said labour cost increased in line with the minimum wages determined by the government.

As far global coal rates are concerned, they have gone up from $95 per tonne to $105 in the past two months only. The coal prices have never declined to $75 per tonne as claimed by an association.

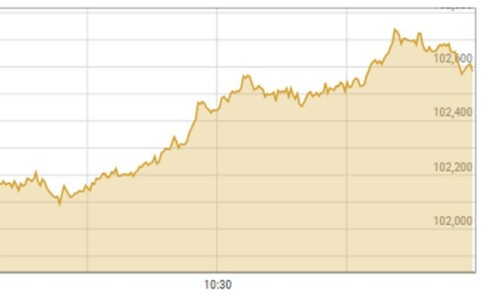

He said the dollar value has increased from Rs98 to Rs106 in last five months.

The landed cost of coal has further compounded due to strict compliance of axle load restriction of coal carriers plus substantial increase in diesel prices since 2010.

This has further increased the cost of production of cement.

The spokesman recalled that in August last year, power tariff for industrial consumers was increased by almost 46pc to Rs15.31 from Rs10.51 per unit whereas time-of-day rate was increased by 35pc to Rs18.81 from Rs13.99 per unit.

The off-peak rate of this category jumped up by 62pc to Rs13.31 from Rs8.22. This also substantially raised cost of production of cement.

The packaging cost also went up due to new taxes imposed on import of sack kraft paper.

Cement makers also rejected the claim of Association of Builders and Developers (ABAD) and said that the increase was due to increase in their costs.

Dear visitor, the comments section is undergoing an overhaul and will return soon.