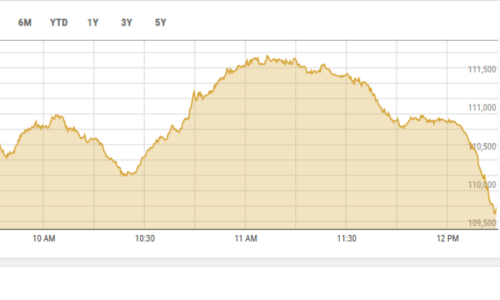

KARACHI: Stocks maintained the rising momentum on the first trading session of the week with the KSE-100 index up by 188.34 points to a new all-time high at 30,413.23.

Foreign investors’ interest in Pakistan equities, fueled by last week’s upgrade by Moody’s, saw an inflow of $5.59 million on Monday with major investment of $1.7m in oil and gas sector; $1.5m in cements and $1m in banks. Mutual funds, for a change, took fresh positions of $5.78m on Monday.

KSE-100 index crosses 30,000 level

The heavyweight Oil and Gas Development Company Limited (OGDCL) posted good gains of R5.01, which alone accounted for addition of around 85 points to the index.

Askari Bank hitting its ‘upper circuit’ was the most prominent gainer in the banking sector as the bank reported half year earnings per share at Rs1.7 versus a loss last year and paid out an interim cash dividend at Re1 per share.

|

Ahsan Mehanti at Arif Habib Corp commented that stocks rose after the State Bank of Pakistan (SBP) hinted at improving economic fundamentals in the monetary policy statement on Saturday.

The rally was led by selected stocks across the board. Renewed foreign interest in oil stocks, speculations ahead of major earning announcements due this week played a catalyst role in bullish sentiments at KSE.

Pakistan Petroleum Limited (PPL) gas discovery and venture plans for power production, rising cement exports and higher international oil prices positively impacted the sentiments.

Analyst Ovais Ahsan said that the SBP’s decision to keep the policy rate unchanged gave the bulls a strong reason to keep marching forward.

The cement sector gained, led by Lafarge Cement up 3.2 per cent on rumors that a bidder will raise its acquisition bid to above Rs21 per share for the company.

Published in Dawn, July 22nd, 2014