GENEVA: Switzerland’s central bank said Thursday it would introduce negative interest rates for the first time in decades to stop the franc getting any stronger, after the Russian ruble crisis sent investors scurrying to the safe haven currency.

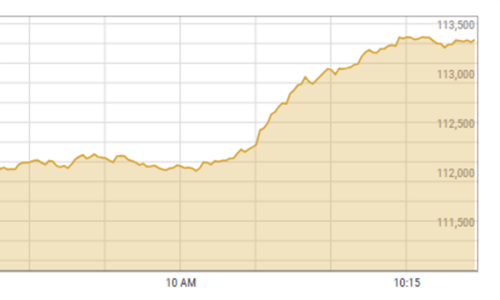

The Swiss National Bank will impose a rate of -0.25 per cent on certain bank deposits on January 22, with the aim of pushing the target range of Switzerland’s benchmark interest rate into negative territory.

“The Swiss franc has been experiencing renewed upward pressure in relation to the euro in the last few days,” said Thomas Jordan, chairman of the SNB governing board.

“Rapidly mounting uncertainty on the financial markets has substantially increased demand for safe investments. The worsening of the crisis in Russia was a major contributory factor in this development.”

The rouble crashed to historic lows this week of 80 to the dollar and 100 to the euro, as the energy-export dependent economy was hit by a rout in oil prices.

With the safe haven Swiss currency in demand, the SNB was forced to take action to protect the country’s vital export sector.

The negative interest rate will be imposed on so-called sight deposits, funds which can be accessed immediately, but only apply to balances above a certain threshold.

The measure will have the effect of taking the three-month Libor rate, which Switzerland uses to determine interest rates on mortgages and savings accounts, into negative territory.

Published in Dawn, December 19th, 2014

Dear visitor, the comments section is undergoing an overhaul and will return soon.