ESTABLISHED in 1860, the Murree Brewery is one of the oldest public companies in the subcontinent. Its two manufacturing units are located in Rawalpindi and Hattar, Khyber Pakhtunkhwa. A Tetra-Pak packaging facility was added in 2001.

Although alcoholic sales currently contribute 60pc to the firm’s turnover, the company’s CEO Isphanyar Bhandara said last week he wanted to turn that around and derive 60pc revenue from sales of non-alcoholic beverages.

He also disputed the notion that the company faces no competition in the country. “Two breweries have sprung up in Sindh and are owned by powerful political personalities of the province,” he said.

Murree Brewery’s financial statements show that by March 31, its liquor division’s assets were valued at Rs6.68bn, the glass division’s at Rs727m and the Tops division’s at Rs827m. Bhandara said the company had undertaken expansion projects in all areas of operation. “We intend to double the production capacity in all divisions.”

The expansion at the glass division in Hattar will cost Rs500m. Meanwhile, the production capacities of the Tops and mineral water projects will also be doubled. The CEO said the entire expansion will be self-financed.

Murree Brewery’s CEO said it had undertaken expansion projects in all areas of operation and it intended to double the production capacity in all divisions

Looking at the strength of the company’s balance sheet, it is evident that it does not need to borrow. By the nine months ending March 31 (9MFY15), the company held huge reserves of Rs4.34bn, of which Rs2.68bn were held in cash and with banks. Its paid-up capital stood at Rs230m.

The company has been following the policy of balancing, modernisation and expansion since the 1990s. New beer-canning and modern bottle-filling facilities were acquired from Germany and installed. Two units of alcohol-rectification columns for producing extra neutral grade of potable alcohol from molasses were procured from France and Italy. Beer-fermentation capacities were renewed during the period as well.

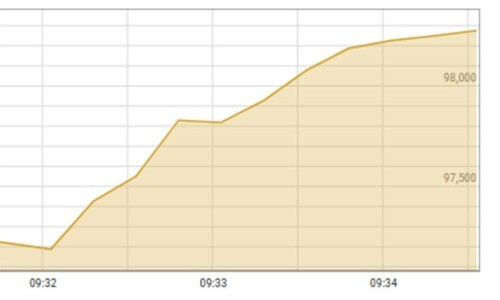

Although Murree Brewery has ample free-float — with 711 local investors holding 32pc of the paid-up shares and eight foreign companies having a 17pc stake — the company’s stock is moderately traded at the Karachi Stock Exchange. Its Rs10 par value share closed last Thursday at Rs1,044.

For the year 2014, Murree disbursed a dividend of Rs6 per share. And while its board issued bonus shares for many years in a row, the chain was broken last year as the government imposed a tax on bonus issues.

Among foreign equity holders, the THS Kingsway Fund-Frontier Consumer — a Luxembourg-based specialised investment fund — is the largest stakeholder. The foreign fund had also raised its stake in another Pakistani food company, National Foods Limited, to 13.44pc this June.

For 9MFY15 (the latest period for which accounts are available), the firm’s after-tax profit grew 34pc to Rs812m. Its property, plant and equipment was valued at Rs3.89bn, and a sum of Rs2.731bn was marked as ‘surplus on revaluation of property, plant and equipment (net of tax)’. A major item among current assets was the stock in trade, which was valued at Rs1.13bn.

The condensed profit and loss account for 9MFY15 showed sales of the liquor division at Rs3.35bn, which, after deducting duties and taxes, amounted to Rs1.37bn. The turnover of the glass division stood at Rs720m and that of the Tops division Rs938m.

The company made an operating profit of Rs1.08bn, representing a 34pc rise over the same period last year. Its other income clocked in at Rs194m against Rs127m last year, while its profit-before-tax amounted to Rs1.2bn, an increase of 37pc year-over-year.

In the directors’ report, Murree’s chairman, Khurram Muzaffar, told shareholders that “the company has contested the imposition of the gas infrastructure development cess by the federal government, along with other organisations. The Islamabad High Court has ordered a stay on the imposition of the cess and the company expects a ruling in its favour”.

The liability, which amounted to Rs67.5m, was not charged in the accounts as it was marked as ‘contingent liability’ — a liability that may or may not occur.

For FY14, the company had earned Rs963m on sales of Rs7.22bn. The profit-after-tax was the highest in the company’s history. That year, the brewery had also contributed a sizeable sum of Rs2.5bn to government in the form of taxes and duties.

Published in Dawn, Business & Finance weekly, September 14th, 2015

On a mobile phone? Get the Dawn Mobile App: Apple Store | Google Play