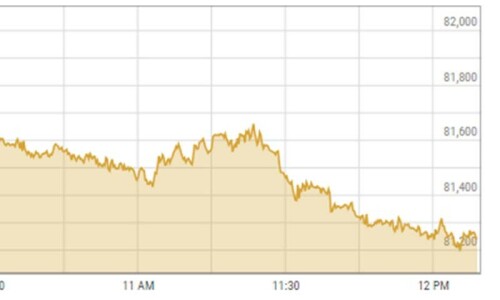

LONDON: Investors pulled a combined $75 billion from US and emerging market equity funds in the third quarter, wiping a record $10 trillion off the value of global equities in the period, according to EPFR Global and Bank of America Merrill Lynch.

In data released late on Thursday, Boston-based fund tracker EPFR Global said European and Japanese funds were the only equity classes to receive net inflows between July and September, most likely motivated by the possibility of more central bank money-printing.

Funds pulled $35.2bn from dedicated US equity funds over the quarter, according to EPFR, bringing year-to-date outflows to $138bn.

That along with September losses in European markets has led to a $10tr drop in global equity market capitalisation, the largest quarterly fall ever, BAML said. Global equity market cap now stands at $60 trillion, a two-year low, after peaking at $71tr in April, the bank said.

The latest week saw global equity fund redemptions of $6.6bn, the bank said in its weekly report, which also uses EPFR figures. This coincides with a setback for European stocks that have been hit by troubles at mining firm Glencore and German automaker Volkswagen.

European equities remain broadly in favour however. Dedicated Europe funds saw tiny $20 million outflows in the past week, but Q3 inflows amounted to $31.3bn or 190 per cent of the full-year record set in 2013.

EPFR added also that Japan equity inflows of $25bn were the biggest quarterly figure since it started tracking them at the start of 2002.

Japanese and European equities have absorbed $56.4bn and $104.5bn year-to-date, well above last year’s levels, the data shows. US outflows are running at $138bn, dwarfing the $32bn received last year.

“Mutual fund investors continued to pin what faith they have on markets and asset classes supported by robust quantitative easing programs,” EPFR said.

But fears of how the Volkswagen emissions scandal would affect German companies led European flows to favour Italian and Dutch equity funds towards the end of the third quarter, BNP Paribas noted, citing EPFR.

European investment grade as well as junk-rated credit saw bigger losses of $824 million and $617m respectively in the third quarter, partly as a result of these problems.

Fears for China’s economy deepened over the quarter as the country suffered a huge equity plunge and devalued its currency, while economic data in most emerging markets confirmed fears of a protracted growth slowdown across the developing world.

While the US Federal Reserve held off raising interest rates in September it could move in December, despite the increasingly fragile outlook for world growth, especially in China and emerging economies.

Bond funds of all stripes saw outflows in the third quarter. Global bond funds lost $16.9bn while US and European debt shed $8.9bn and $2.8bn respectively.

Published in Dawn October 3rd, 2015

On a mobile phone? Get the Dawn Mobile App: Apple Store | Google Play

Dear visitor, the comments section is undergoing an overhaul and will return soon.