KARACHI: Rising demand pushed the dollar to as high as Rs106.50-70 in the open market on Monday creating space for the inter-bank rate to jump, like it happened in the past.

Greenback’s demand from the general public has also been on the rise, currency dealers said.

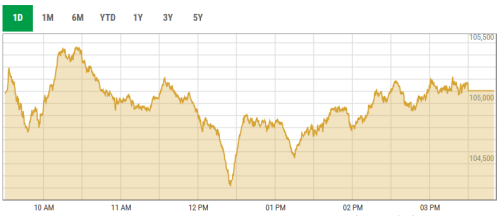

The inter-bank market, however, showed stability as the prices remained close to Rs105.50-58.

The gap between the two markets has widened to Rs1.10, something currency experts describe as alarming as it indicates that a room is being created to push the dollar price in the inter-bank market.

Earlier, the local currency was devalued twice when the price gap increased by Rs2 per dollar. Currency experts believe the government has committed to the International Monetary Fund for rupee’s devaluation.

The IMF on Sunday issued a statement regarding Pakistan’s exchange rate and said that the country’s nominal exchange rate should continue to be market-determined.

Any implied overvaluation of the real effective exchange rate can be corrected over the medium term, it said.

Currency dealers said the market got message from the IMF that further devaluation is possible in the coming days which encourages buyers.

The greenback shot up to as high as Rs106.70 on Monday, said currency dealer Anwar Jamal, adding that the rate softened by the close of the day.

However, currency dealers said the inter-bank market is also set to move up, but the powerful influence by the central bank is keeping the dollar from rising.

“If the cork is opened the dollar rate will jump again as we have witnessed in the recent past,” said Atif Ahmed, a currency dealer in the inter-bank market.

Bankers said importers were in a hurry to buy dollars amid frequent depreciation of the dollar.

The exporters and their lobby in Islamabad and Karachi were demanding further cut in the rupee’s value as it helps boost exports.

The reason for the demand is to increase exports that will ultimately reduce the trade gap and increase inflows. However, steps taken in the past to devalue the local currency have never helped exports to move up.

Published in Dawn, November 10th, 2015