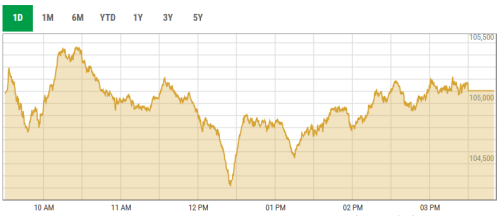

KARACHI: The State Bank of Pakistan called a meeting of exchange companies after US dollar value climbed to Rs107 in the open market on Tuesday and assured steady supply of the greenback at a fixed rate.

“The State Bank has assured the exchange companies of providing the dollar at Rs105.90 while we pledged to sell it at Rs106.20,” said Malik Bostan, president of the Forex Association of Pakistan (FAP).

The new open market rate manoeuvred by the State Bank is higher by 40 paisa compared to the inter-bank rate. He anticipated a fall in the exchange rate after liberal supply from the central bank.

Also read: Dollar trades higher at Rs106.50 in open market

The SBP said current level of exchange rate is in line with the economic fundamentals and is consistent with the improved external position of the country, achieved through contained external current account deficit at low levels, continued surplus in overall balance of payments and build-up of foreign exchange reserves to record highs.

“The SBP expects the external position to continue to strengthen and stands ready to take any measure to ensure stability in the foreign exchange markets,” it said in a statement issued on Tuesday.

During their meeting with the State Bank, exchange companies held the International Monetary Fund responsible for the current devaluation of local currency. “The IMF suggested that the rupee is overvalued by 5 to 20 per cent which encouraged dollar buying,” said Bostan.

However, the State Bank in its statement held media responsible for the current devaluation as it persistently criticised the government borrowing operations.

“During the past couple of days the rupee has been once again facing speculative pressures due to some recent newspaper articles criticising external borrowing of government and the quality of reserves of the country,” said the SBP.

The media reports and articles, according to the central bank, are highlighting just one aspect of the debt dynamics without contextualising it in Pakistan’s current performance and the overall macroeconomic stability.

Moreover, reference to reports by international rating agencies, such as Moody’s, is also being made conveniently ignoring the strengths of the economy highlighted in the same report, the statement added.

While referring to Moody’s reports, columnists have overlooked their recent assessment which noted that “the support from multilateral and bilateral lenders bolsters an improving foreign reserve position and ongoing reform progress”.

Moody’s has also mentioned that while Pakistan’s government financing is mainly from domestic sources and system-wide external debt is declining as a per cent of GDP, the level of public debt poses a moderate degree of credit risk.

“Pakistan’s external debt obligation has actually decreased from 33pc of GDP in FY10 to 23pc at the end of FY15. Similarly, despite stagnant exports, the external debt to exports ratio has declined from 300pc in FY10 to 255pc in FY15,” said the SBP. “Moody’s has appreciated the progress on structural reforms undertaken by Pakistan.”

Published in Dawn, November 11th, 2015