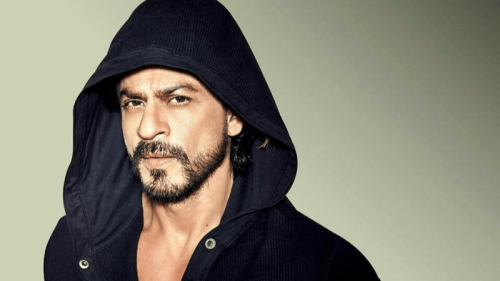

KARACHI: A day after his party denied that Imran Khan owned a flat in London through an offshore company, the Pakistan Tehreek-i-Insaf (PTI) chairman himself admitted he had formed the offshore company to buy the flat in 1983 to evade British taxes.

Speaking to reporters at London’s Heathrow Airport, Mr Khan said he formed the offshore firm on the advice of his accountant to evade taxes and to buy a flat in London.

“I was already paying 35 per cent tax on my income there [United Kingdom], so to evade further taxes, I bought the flat through an offshore firm, which was my right as I was not a British citizen,” Mr Khan said.

Social media users were quick to react to the news, calling the PTI leader out for an April 4 tweet in which he had stated, “Only reason ppl open offshore accts through Panama is to either hide wealth, esp ill-gotten wealth, or to evade tax or both.”

The prime minister’s daughter, Maryam Nawaz, too hit out at her father’s most vocal critic.

“The ‘PIONEER’ of offshore companies ..... The TRAILBLAZER award goes to Mr. Khan. #Hypocrisy,” she posted on Twitter.

PTI spokesperson Naeemul Haq also admitted during a talk show shortly before Mr Khan’s media talk that his party chief had formed a ‘legal’ offshore company through his earnings from cricket.

Speaking on a Geo News talk show, the PTI spokesman withdrew his earlier denial about the ownership of the flat.

“I was Imran Khan’s bank manager in London at that time. His accountants formed this company to buy the London flat,” said Mr Haq. He added that when the flat was sold, Mr Khan brought the money to Pakistan through Habib Bank.

In an interview published in The News a day before, Mr Haq was quoted as saying Mr Khan himself owned the flat and it was not bought by an offshore company.

The report published in the paper stated that a ‘Benami’ offshore firm ‘Niazi Services Limited’ owned Mr Khan’s flat in South Kensington, London. The offshore firm was established for ‘sporting consultancy’.

When asked why he denied the existence of the offshore company earlier, Mr Haq simply said he forgot.

In response to a question about Mr Khan’s tax returns and this

offshore firm, Mr Haq said he would give the details to the media on Saturday after talking to Mr Khan’s accountant.

Published in Dawn, May 14th, 2016

Dear visitor, the comments section is undergoing an overhaul and will return soon.