KARACHI: A consortium of 16 banks has arranged Rs100 billion sukuk for the Neelum-Jhelum Hydropower Project in what is the country’s biggest ever funds mobilisation for a public sector entity.

The National Bank of Pakistan (NBP), which leads the consortium, has the largest share (of around Rs35bn) in the funds being raised under Shariah-compliant tool.

Mufti Ahsan Waqar, chairman of NBP’s Shariah board, told Dawn that financial closure for the sukuk has been achieved and the bonds would be ready to trade on the stock market after completion of other formalities.

The fund is Pakistan’s biggest for a public sector entity

A signing ceremony for the financing agreement was attended by President and CEO of NBP Syed Iqbal Ashraf, Water and Power Development Authority (Wapda) Chairman Zafar Mahmood, Wapda’s Member Finance Anwaarul Haq and Neelum-Jhelum Hydropower Company (NJHPC) CEO Muhammad Zubair, among others.

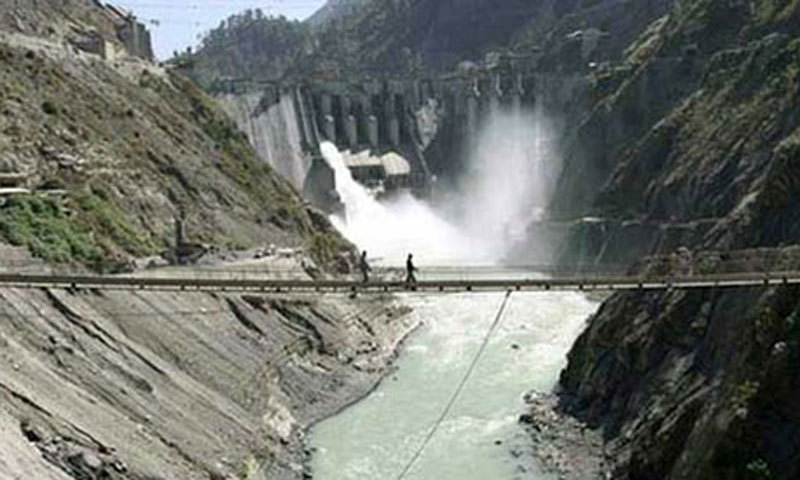

The NJHPC, which is managing the 969-megawatt project located in Muzaffarabad (Azad Jammu and Kashmir), has assigned the NBP the role of ‘mandated lead arranger’ for the arrangement through issuance of rated, secured and privately placed sukuk to partially finance the construction.

Pakistan has struggled to attract foreign investment in the power sector, particularly for the hydroelectric projects which have vast scope for investment and profitability. However, the response was not positive except China which has agreed to invest in Pakistan’s power sector under long-term loans for power generation.

Addressing the signing ceremony, Mr Ashraf said the sukuk was structured with a tenor of 10 years and was backed by the sovereign guarantee by the Government of Pakistan (GoP).

He said the bonds issue has received a preliminary rating of ‘AAA’ from JCR-VIS and is expected to have a wider impact on the financial market of Pakistan, helping augment a funding format that has been predominantly constrained to smaller deals with shorter tenors.

This sukuk is also expected also provide avenues for Islamic banks and mutual funds to invest their liquid funds in a tradable GoP-guaranteed Islamic instrument.

Apart from the NBP, other banks in the consortium are HBL, Allied Bank, United Bank, Bank Alfalah, Meezan Bank, Faysal Bank, the Bank of Punjab, BankIslami Pakistan, Askari Bank, Bank Al Habib, the Bank of Khyber, Dubai Islamic Bank, Pak-Brunei Investment Company and Pak-China Investment Company.

The Neelum-Jhelum project envisages diverting Neelum River water through tunnels which falls into Jhelum River after producing power. On completion, the project will be capable of producing 5.15bn units of electricity each year. This mega hydropower project has been undertaken long after completion of Mangla and Tarbela dam projects.

This ‘green energy’ project will fetch a total revenue of up to Rs50bn annually for Wapda as per existing tariff. The first turbine will start to operate by the end of June 2017.

Addressing the ceremony, the Wapda chairman said this was the biggest ever funds mobilisation for a public sector entity in the history of Pakistan. “Achieving this milestone reflects not only investors’ confidence in the federal government and Wapda, but also indicates the potential of investment that hydropower sector offers,” he said.

“This issuance... will go a long way in arranging funds for other hydropower projects as well to be initiated in the near future,” he added.

“The project envisages 90 per cent construction work under high mountainous overburden and only 10pc above the surface. He said the construction work on the project is progressing at a fast pace and overall progress of the project is around 82pc so far.”

Published in Dawn, June 23rd, 2016