KARACHI: The federal budget 2016-17 and an amendment to the Income Tax Ordinance 2001 have begun to impact the real estate sector.

Pakistan’s real estate market has witnessed bullish trend for last four years and a drastic price hike in the last one year. Estate agents believe that after the budget announcement 2016-17 and the amendment, the scenario has changed and the market is cooling down.

An important amendment was made to Section 68 of the Income Tax Ordinance 2001 through the Finance Act 2016, effective from July 1, 2016. Under the amendment, the provincial governments are no longer relevant as all properties would be evaluated through the valuers of the State Bank of Pakistan (SBP).

One or more valuers of the SBP would fix the market value of immovable property and refer it to FBR’s in-land revenue department.

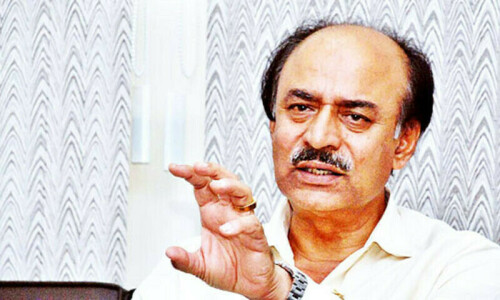

President DHA and Clifton Association of Real Estate Agents, Raja Mazhar claimed a dip of 10-20 percent in property prices in posh areas of the city following the announcement.

He said the amendment in the income tax ordinance would discourage investment in real estate as the sector may lose attraction for overseas Pakistanis. He warned that it might eventually depress the inflow of remittances in the country.

Mr Raja said many buyers and sellers who had taken advance token for the property deal in June are now in two minds. The reports of dishonouring of cheques in banks are adding to their tension. Besides, buyers and sellers trying to strike a deal after Eid are also shaken.

He said the government should raise official value of the property only where it is necessary. The measures would not help the government in achieving its revenue targets in view of declining deals in future, he claimed.

Vice Chairman FPCCI Standing Committee on Real Estate Research and Image Building, Muhammad Shafi Jakvani said since 1986, all property transactions were being evaluated according to provincial government’s valuation table. He acknowledged that property was under priced by two to 25pc.

Due to this huge difference between market and documented value, the government was bearing huge losses in revenue.

Mr Jakvani said the Collector rate provided by provincial governments will not be valid now. It will increase the transaction cost but remove a major anomaly.

He said the amendment would discourage black money from entering the sector and will open the doors to foreign direct investment (FDI) in this sector.

However, this arrangement will not work because of the huge difference between the documented values of properties and real market prices, he warned.

He went to add: “It will bring down real estate prices in the market for the initial period of this amendment and in the long run will benefit the government and investors.”

CGT calculation revision

Besides the amendment, the Capital Gains Tax (CGT) calculation has also been revised.

The CGT was re-introduced after 26 years in the 2013-14 budget and then rescheduled in 2014-15 budget. Now, the tax percentage and time frame both have been revised.

Previously, CGT was applicable on property sold within 1 and 2 years time at a rate of 10pc and 5pc accordingly. Now the time frame has been increased to five years and 10pc CGT will be applicable. At the time of transaction it will be payable at the rate of one per cent for filer and two per cent for non-filer, revised from 0.5pc and one per cent accordingly.

Advance tax was already imposed in the last budget which will be applicable on the property above Rs 3 million. Now the percentage has been changed to two per cent for filer and four per cent for non-filer from one per cent for filer and 2pc for non-filer.

Previously, as per collector valuation table, most property prices were calculated and documented price at lower than Rs3m but after this amendment, property prices will be assumed on real market value and most of the properties will be above the ‘three million slab’.

After the federal budget, there is the provincial budget in which Collector values have been provided. This time, the given values have been revised and increased by 20pc.

In Sindh budget, stamp duty charges have been revised and increased by 50pc too.

Advance tax has also been revised and will be paid by the seller. It is 2pc of the Collector Rate applicable on property value of Rs3 million and above for the filer, and 4pc for non-filer, from 1pc for filer and 2pc for non-filer.

Stamp duty has also been revised and increased by 50pc which will be paid by the buyer on transfer documents; it was 2pc of the Collector Rate of any property. Now it has been increased by 50pc.

Registration fee paid by the buyer for the registration of documents in registrar office is applicable at one per cent of the official value declared by the collector value table.

Published in Dawn, July 9th, 2016