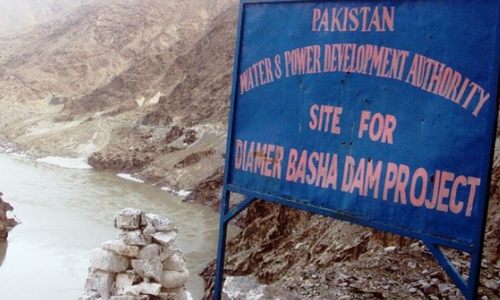

ISLAMABAD: Despite disbursement of maximum funds, more than 9,000 acres of land have yet to be acquired for the $14 billion Diamer-Bhasha dam project. The delay threatens to put back its take-off.

The government and the Water and Power Development Authority (Wapda) had set a target for completion of land acquisition by June this year before moving on to the next stage of project implementation — arrangement for funds and award of contracts for construction.

This is all the more surprising because the federal government has already made a full disbursement of Rs14 billion in the first three months of the current fiscal year — nine months before the stipulated date of June next year — according to a Planning Commission official.

He said the government was fully committed to the multipurpose project and was going out of the way in disbursement of the funds. He said the government had so far disbursed about Rs72bn, adding that the National Economic Council (NEC) had allocated Rs14bn for the project this year and “we have disbursed this Rs14bn within the first quarter”.

Project was first slated for completion in 2016, and then 2019

The water and power ministry informed parliament last week that 28,247 acres of land had been acquired so far against a total requirement of 37,419 acres. About 9,172 acres (25 per cent of the total land) has yet to be acquired.

The project on completion would have an installed capacity of 4,500MW, with annual power generation of about 19,208 gigawatt hour (Gwh).

The official said that most of the land needed for the project had already been acquired and land titles transferred/registered, adding that the remaining work was expected to be completed shortly. He said it was for the first time that matters relating to acquisition of land and resettlement of people to be displaced were being resolved before the start of work on the project.

This will avoid usual project delays and cost overruns that occur in most major development projects because of litigation and land registration. For example, the cost of the Mangla dam raising project had increased from Rs62bn to Rs105bn mainly because of litigations relating to land acquisition and resettlement.

The construction of Diamer-Bhasha dam has already been delayed. The project was originally scheduled for completion in 2016, and then 2019, when a decision about its construction was taken by the military government of Gen Pervez Musharraf, but it could not move an inch during his rule.

Officials explained that land acquisition was the first requirement for raising local and international financing for the project. About 37,500 acres have to be acquired, including about 18,500 acres of private land. All paperwork has been completed to formally seek financing from international agencies and bilateral lenders.

Multilateral institutions, primarily the Asian Development Bank, have advised the government to adopt a professional approach for building the big dam as no single institution, country or group can finance it given its mammoth funding requirements and the risks involved.

About 80pc of the required financing — more than $10bn (Rs1.1 trillion) — will have to be raised through external sources and the remaining through domestic arrangements. Therefore, authorities have now decided to divide the project into two components — construction of the dam and power project. The government now intends to seek financing for the power project in the independent power project (IPP) mode and raise funds for the dam through institutional lending and international bonds.

While a part of the external financing can be arranged by a few institutional lenders, the major financing will have to be received from the international capital market as a specific infrastructure bond in the name of Diamer-Bhasha Dam Company (DBDC) — a special purpose vehicle.

Based on market and domestic circumstances, the DBDC can be offered to international investors next fiscal year with a targeted completion date of June 2026. To meet the deadline, the DBDC will be built on the pattern of the Neelum-Jhelum hydropower project through transfer of cost of land of the dam and operating assets of the 1,450MW Ghazi Barotha hydropower project (GBHP).

The GBHP’s revenue surplus of about Rs9bn per annum and net worth of about $500 million is not sufficient to meet local financing requirements. Therefore, a special cess on the pattern of Neelum-Jhelum surcharge on electricity tariff will be imposed on GBHP’s tariff which can range between Rs10 and Rs15 per unit to make the Diamer-Bhasha dam project attractive for investors.

There is a move to increase GBHP’s tariff to Rs23 per unit by loading on the project cost of DBDC because a combination of operation and development activities will not be attractive for short-term investors. The official estimate put return on equity at 17pc based on a 30-year average tariff of about Rs7.75 per unit. The project will also have a usable water storage capacity of about 6.4 million acre feet.

Published in Dawn, December 5th, 2016