KARACHI: After failed attempts in the previous two sessions to settle above 50,000 points, the KSE-100 index finally managed to accomplish the feat for the first time on Thursday.

The buying frenzy intensified in the last hour, which saw the index surge 435.59 points, or 0.88 per cent, to close at 50,192.36. With the addition of Rs60 billion on Thursday, the market capitalisation of the Pakistan Stock Exchange (PSX) also reached Rs10 trillion.

The meteoric rise of the PSX, which began in November last year, is attributed by some analysts less to the underlying companies’ prospective earnings and growth and more to the liquidity that swamps the market.

And investors are banking on more cash entering the market. Analysts are looking at foreign portfolio investment of around $300m-500m, following the reclassification of the PSX into the MSCI emerging-market category from frontier markets in May this year. The receipt of $100m by stockbrokers for the sale of 40pc strategic shares and 20pc stock in initial public offering to local investors is also reckoned to make its way into the equity market.

Having provided a record return of 46pc in 2016, investors have entered the market in droves sending stock prices to hit the ceiling. Although foreign investors were persistent net sellers of $267m worth stocks in 2016, it was successfully absorbed by the mutual funds and individuals.

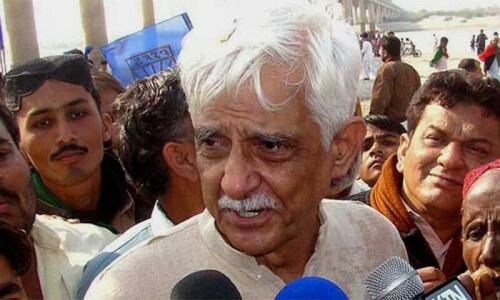

Arif Habib, former chairman of the stock exchange, cited the low interest rate regime, expectation of growth in corporate profits and improvement in security situation in the country as the reasons for the high-flying stocks. “Things could get better as the perception over the future of Pakistan economy improves and energy shortage is addressed,” he said.

A big sentiment booster has been the recent divestment of 40pc PSX strategic stock to the Chinese consortium, comprising four Chinese exchanges and two local financial institutions. “The Chinese participation would add value to the PSX due to possible technological advancement, product development and potential cross-border listing,” analysts say.

Published in Dawn, January 27th, 2017