The Pakistan Stock Exchange has started the week on a positive note, with the benchmark KSE-100 index gaining 636.96 points, or 1.23 per cent, by the close of the trading session to reach 52,387.87.

Volumes were led by commercial banking stocks as the market was bolstered by the impending MSCI reclassification due early tomorrow.

147.88 million shares of indexed companies changed hands by the close of the session, with a total worth of nearly Rs17.6 billion.

"Stocks surged to new highs led by oil and banking scrips as investors bet over MSCI EM upgrade announcements and surging global equities on higher global crude prices," said Arif Habib Corp's Ahsan Mehanti.

"Pre-budget speculations in steel, cement sectors amid gains from CPEC projects, surging exports in textile sector and renewed hopes for economic growth on OBOR initiatives played a catalyst role in the record close," he added.

"Pakistan equities closed third consecutive session higher and at a new all-time high with oils along with and select index names leading the day's gains," read a note issued by Elixir Securities.

"The market opened gap up as index-heavy oils attracted attention from the word go after investors the world over cheered an extension in the supply cut agreement between Saudi Arabia and Russia," it added.

"The wider market followed suit and edged up, with notable sectors — including financials, cements, fertilizers and steels — finishing the day with modest gains as participants cherry-picked value plays with stocks that are candidates for inclusion in the MSCI Pakistan Index or the ones that stand to benefit most from CPEC and related infra-structure projects," it said.

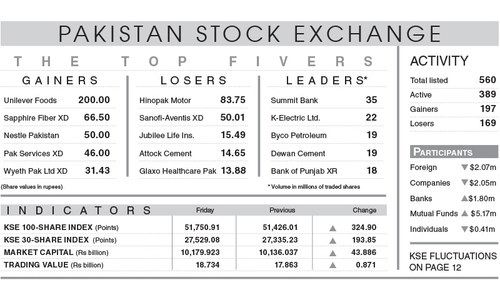

Stocks of 399 companies were traded, of which 204 gained in value, 178 declined and 17 remained unchanged.

Volumes were led by:

Engro Polymer: 35.9m shares traded [+2.20pc];

Dost Steels Ltd: 19.5m shares traded [+7.58pc];

Bank of PunjabXR: 12m shares traded [+0.36];

K-Electric Ltd: 10.1m shares traded [-2.86pc]; and,

Azgard Nine: 9.76m shares traded [+0.29pc].