The Nawaz Sharif government’s last budget is more or less an extension of the China-Pakistan Economic Corridor initiative.

It is an effort by the government to complete the energy and road development projects before going into the 2018 elections to give something to the voters in an election-year.

The job of distributing relief and goodies (in the ruling party’s vote base in Punjab) has been left for the provincial government without bringing a lot of pressures on the squeezing federal expenditure.

Ishaq Dar, the finance minister, said in his speech that the federal Public Sector Development Programme (PSDP) sets aside Rs180 billion — or slightly less than a fifth of the total outlay that has been spiked by a quarter from the original PSDP estimates of Rs800bn for the outgoing fiscal to Rs1 trillion for 2017/2018 — for the projects under the Corridor initiative.

But a detailed study of the budget documents clearly indicates that the energy and road development projects, directly or indirectly linked with the regional connectivity initiative, will consume a better part of the cash allocated for the PSDP.

The highest priority has been given to the transport and communication sector with an allocation of Rs411bn, including Rs320bn for highways. The energy sector has been assigned the next priority with an allocation of Rs401bn, including an investment of Rs317bn to be undertaken by Wapda/Pepco/NTDC.

Interestingly, China has also emerged as the single largest lender of money to Pakistan ever since the two countries decided to undertake the CPEC project a little more than two years back.

“Accumulation of foreign debt in the midst of ever falling exports is but a risky strategy…”

Beijing will provide loans of Rs168.3bn, including Rs1.3bn as grants for the international airport and a vocational training centre in the port city of Gwadar, to Islamabad next year. Over 55pc of the Chinese loan, or Rs93.4bn, is meant for the controversial orange line metro train project in Lahore.

The amount of Chinese loans booked in next year’s budget is more than 26pc greater than the loans (inclusive of a grant component of Rs2bn) of Rs132.8bn received from China during the present financial year. Originally, the country’s finance managers had booked only Rs59.8bn as ‘foreign assistance’ from China.

Also, it forms a fifth of the entire loans, of Rs837.8bn, the government intends to raise from foreign sources to support its development and finance current account deficit that is projected to grow to 2.7pc of the size of the economy by the end of the present year.

“The Chinese footprint on Pakistan’s economy is expanding as the CPEC initiative nears completion. I don’t consider it a bad thing for the country as long as the government decides to make public the details of the cost of the deals made with China’s government and its firms to trigger a healthy debate, and protect the interests of the local businesses and investors,” a Lahore-based financial analyst noted.

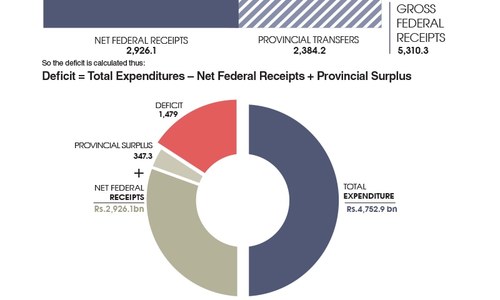

In spite of spiking the total development outlay for the next year by 24pc to Rs2.1tr (this includes Rs1.1tr for provincial development programmes), the government has tried to protect the fiscal side of the budget by controlling its current expenditure and mopping up additional tax revenue of Rs500bn, up by 13pc, from the revised estimates of Rs3.8tr for the outgoing year.

“It is a revenue-driven budget. The minister has seen an opportunity to further tax high growth sectors like cement, construction and steel that are catering to domestic demand, and extended the Super Tax on large corporations for another year besides incomes from stock market,” contended Saad Hashmi, the chief executive of Topline Securities. “Additionally, he has tried to bring more pressure on non-filers.”

However, analysts warn, any slippages in the tax and non-tax revenues the government has booked could hit its effort to strike the difficult balance between its expansionary development spending and fiscal sustainability in the election year.

“We have seen in the recent past that the government was forced to take recourse in additional, expensive borrowing from external sources whenever it missed its revenue targets, resulting in accumulation of more foreign debt,” says the analyst from Lahore.

“Accumulation of foreign debt in the midst of ever falling exports is but a risky strategy and the way the current account has widened this year to $8.3bn from $2.5bn last year shows that even rising Chinese investment and lending does not guarantee external sector stability.”

Published in Dawn, The Business and Finance Weekly, May 29th, 2017