The world is in transformation and the energy world is no exception, Paris-based International Energy Agency notes in its much-awaited World Energy Outlook (WEO) 2017 released last Tuesday. However, nothing is certain over the long term energy horizon, the IEA is now conceding.

In view of the emerging, new variables impacting the global energy equation, the IEA cut its oil demand growth forecast by 100,000 barrels per day (bpd) for both 2017 and 2018. This means that the global oil consumption may not breach 100 million bpd next year as many were anticipating.

And in the meantime, the US is emerging as a dominant, global energy player. Already, US crude oil production has jumped more than 14 per cent since mid-2016 to 9.65m bpd and is expected to grow still further.

The US will be a dominant force in global oil and gas markets for many years to come as the shale boom becomes the biggest supply surge in history, IEA said.

By 2025, the growth in American oil production will equal that achieved by Saudi Arabia at the height of its expansion and increase in natural gas output will surpass those of the former Soviet Union, the IEA added.

The boom will turn US — still among the biggest oil importers — into a net exporter of fossil fuels.

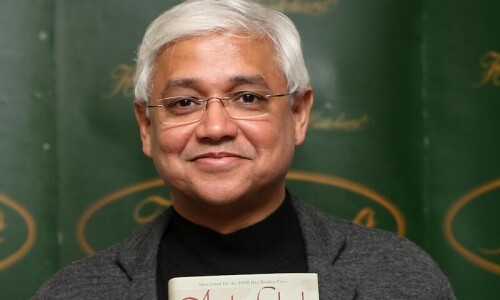

“The United States will be the undisputed leader in global oil and gas markets for decades to come,” IEA Executive Director Fatih Birol told Bloomberg television. “There’s big growth coming from shale oil, and as such there’ll be a big difference between the US and other producers.”

The agency also raised estimates for the amount of shale oil that can be technically recovered by about 30 per cent to 105bn barrels. Consequently, forecasts for shale-oil output in 2025 were bolstered by 34pc to 9m bpd.

All this is a far cry from the Organisation of Petroleum Exporting Countries (Opec) halcyon days when the group controlled and swayed the global energy markets at its will.

Even in the shorter run, the situation does not appear rosy from Opec’s viewpoint. As per WEO, non-Opec production would rise 1.4m bpd in 2018, undermining efforts by the Opec and other producers to limit global crude supplies and support prices.

In the wake of abundant new supplies coming to markets, the IEA also cut its forecasts for oil prices significantly — to $83 a barrel for 2025 from $101 previously and to $111 for 2040 from $125 before. But this could change too, the IEA admits.

The agency, however, remains hopeful on some counts, underlining that the global crude consumption would rise through 2035 — despite the growing market share of electric vehicles.

Yet, in view of the changing variables, the IEA is finding it difficult to stay emphatically optimistic. At one stage, it points out that US shale output is expected to decline from the middle of the next decade. With investment cuts taking their toll on other new supplies, the world will become increasingly reliant once again on Opec, with its market share growing to 46pc in 2040 from 43pc now. Yet, in the same breath, it admits, ‘that could still change.’

Similarly, it concedes, if shale resources turn out to be double the current estimates, and the use of electric vehicles erodes demand more than anticipated, prices could stay in a “lower-for-longer” range of $50 to $70 a barrel through to 2040.

“There could be further surprises ahead,” the IEA hence felt like emphasising. Ifs and buts seem to continue to haunt the pundits.

On the other hand, just a day prior to the launch of the WEO, the Opec raised the call on its crude projecting it would go touch 33.42m bpd in 2018 – up 360,000 bpd from its previous forecast and marking the fourth consecutive monthly increase from its first estimate made in July.

Once again, the gap between IEA and Opec projections seems widening on a number of counts.

Geopolitical developments in the Middle East, however, have the capacity to undo all projections. In the given scenario, indeed it’s not easy for good, old, friend Fatih Birol and his team to bet on the winning combination. With little control over emerging variables, the IEA has little option but to be a bit wavy, one needs to concede here.

Published in Dawn, November 19th, 2017