Broadening its tax base is perhaps the most significant economic challenge facing Pakistan. After 70 years of existence, the country has less than two million income tax filers, one of the lowest tax-to-GDP ratios in the world, and a tax system which riddled with inequity and corruption.

But we are not the only country struggling with tax reforms; other have faced this challenge too. The question is what can we learn from them.

To answer this question, I reached out to Dr Mark Gallagher, an economist who has spent three decades in dealing with tax reforms in developing countries.

He has served as a consultant for different organisations, including the World Bank, Asian Development Bank, Inter American Development Bank, USAID, US Treasury, German GIZ, and the European Commission. Here is how Dr Gallagher responded via email to my questions.

Which countries have had some success in broadening the tax base?

Many countries have had success in broadening the tax base. But first, it is important to understand that there are basically three ways to do so:

One is to get people into the tax system who have been outside of it but are supposed to, by law, be paying taxes.

Two, reduce tax incentives that allow businesses that are economically active to not pay taxes. These tax breaks or reliefs include measures such as tax holidays that say that, if you invest in such and such area, industry or for export only, you don’t have to pay tax or you can pay a reduced amount.

And three, reduce the number of goods and services that are not taxed or are taxed at a lower rate than others. For instance, basic foodstuffs in some countries are exempt from value-added tax.

In Bosnia and Herzegovina in the early 2000s, a big push was made to get businesses to register. This worked and revenues rose quite quickly. Later, they reduced tax holidays for corporations and lowered the corporate income tax rate from 30% to 10% and revenues increased.

In Rwanda over the years, the tax administration broadened the tax base by getting more and more people and companies registered, but they did not reduce exemptions and exoneration; revenue rose steadily for a decade.

In Georgia, the government issued a new tax code, I think in 2009, which lowered the corporate tax rate, but also applied the tax rate to all companies in all industries.

This broadening the tax base by eliminating preferential rates coupled with a lower headline rate for all resulted in considerable revenue increases over the subsequent years.

Which countries have not had much success in this endeavour?

I would say the Philippines. There, tax revenues reached their pinnacle (in relation to the overall economy) in 1997, then dropped for the better part of two decades.

Tax revenue has only recently begun to increase, but remains below the 1997 level. Tax incentives run rampant, as does complexity, and some complain of corruption and evasion.

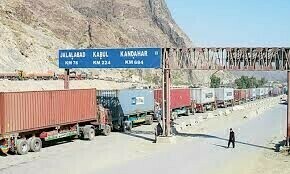

Afghanistan is another country that has not made much effort in broadening the legal tax base, actually since 1965.

Of course, the tax administration was rebuilt over the past 15 years, but other than reaching out to taxpayers around the country, tax law has remained fundamentally unchanged.

What are the key lessons in tax reforms attempting to broaden the tax base?

I would say:

Improve the taxpayer registry to make sure it works well. Make special efforts to identify people who are not registered or paying taxes, including identifying companies hiding in the so-called informal sector.

Take a careful look at all the tax incentives, centralise tax incentive authority in the hands of the Ministry of Finance, but impose a rigorous mechanism for their authorisation.

Report every year on tax expenditures (the revenue lost to these incentives) to add transparency to the system and help build support for reducing tax expenditures and thereby broaden the tax base.

Any lessons on why and how some countries have been able to address corruption in the tax administration?

This is hard to respond to, but there are some cases and some inklings. Perhaps one of the most successful cases is that of the Georgia, where after the overthrow of a sclerotic, corrupt, long-entrenched regime, the country implemented revolutionary change throughout, including cleaning up its tax administration.

Crooked tax officials were either tossed or prosecuted. Most tax officials were fired and replaced with new professionals. Systems of internal control in the tax administration were strengthened.

In El Salvador, in the 1990s, just after the end of the long civil war, the tax administration and other parts of government took pains to root out corruption.

Similarly, in Rwanda, after their terrible genocide of the early 1990s, top to bottom reform of most public institutions included deep anti-corruption measures.

This is how the tax systems in both these countries were able to produce more and more revenue without raising tax rates.

I don’t want to say a country needs to have a revolution to address its corruption problems, but in these cases, it seems to have set the stage for broad reforms.

That said, from my experience of 30 years, all real efforts to fix the tax system also include efforts to impede corruption.

Is it necessarily politically harmful for an elected government to attempt to broaden the tax base?

No, but it is not easy. Strengthening taxpayer registration can be done without any real political push back, but it is not likely to have great financial return, though in Bosnia and Herzegovina it did.

Reducing tax incentives is very difficult politically. Usually the people who benefit from these so-called incentives are very well placed and wield considerable power.

Going after these tax incentives is very important and needs to be done. But it needs to be done very carefully, with full consideration of who loses, how much, and what will be the force of their opposition and how can this be overcome.

Is there a significant role for information technology here?

Yes, but this depends upon the country. The more backward the country, the less scope there is.

On the other hand, IT systems, and especially linking the taxpayer registry to other information sources, such as vehicle registration, air traveller information, real estate or property registration and transfer systems, can help a savvy tax administration identify people who are likely under-reporting income as well as identify people and activities that should clearly be in the tax system but are not.

I explore this a bit in my article Big Data and Domestic Resource Mobilization: How Donors Can Help Developing Countries Increase Revenue.

How would you summarise your views on success stories in broadening the tax base?

Broadening the tax base is the best way to reform a tax system and to increase domestic revenue mobilisation, which is needed to fund our governments and to invest in the future.

Base broadening allows us to raise more revenue without raising tax rates and without harming the economy and national competitiveness.

Broadening the tax base increases the fairness of the tax system, since it shares the tax burden with more people in the economy. It reduces the distortions caused by tax and investment policy that seek to favour one investment or industry over another.

It's something righteous, but tough. The most powerful interests in any economy tend to be those who benefit from tax incentives and they are not going to release their grip from the throat of the political system easily.

Are you an expert working on policy reforms? Share your insights with us at blog@dawn.com