KARACHI: While the government relied heavily on 8-month data for achieving 5.8 per cent economic growth in FY18, the State Bank of Pakistan (SBP)

on Friday disclosed that during the first 10 months both monetary expansion and the private sector borrowing were lower than last year’s corresponding figures.

The monetary expansion during July-April 2017-18 was 4.13pc compared to 6.29pc during the same period of 2016-17. In terms of liquidity, the expansion during the first 10 months stood at Rs603 billion versus to Rs807bn in the same period of FY17. Greater monetary expansion is a sign of higher economic activity while an interest rate scenario with low inflation is highly attractive for monetary expansion and active participation of private sector.

The SBP reported that during the reviewed period, the private sector borrowing from the banking system was Rs498.5bn compared to Rs517bn in corresponding months of 2016-17. Despite low interest rate and inflation, the private sector did not show enthusiasm for its higher participation in the economic growth.

Pakistan had achieved a growth rate of 5.3pc with a monetary expansion of 13.69pc in FY17. At the end of almost ten months of 2017-18, monetary expansion was just 4.13pc, making it seem impossible to achieve the 13pc figure (or additional 9pc) in the remaining two months.

Water shortage is emerging as a crisis for the agriculture sector which is believed to achieve 3.8pc growth in FY18. Water availability for Kharif and Rabi seasons was down by 2pc and 18.5pc, respectively.

The government believes to attain higher large-scale manufacturing (LSM) growth which stood at 6.24pc in the first eight months of 2017-18 while the energy crisis has been worsening as the summer approaches.

Textile, which has the adjusted weight of 29.74pc in the basket of LSM, actually went down to 0.47pc growth compared to last year’s 0.58pc.

Food, beverages and tobacco with adjusted weight of 17.59pc rose by 2.33pc against 7.12pc in the same period of FY17.

The government heavily relies on automobile and iron and steel sector for its higher LSM growth rate. The automobile sector, with a share of 6.56pc, increased by 19.58pc versus 10.08pc in the corresponding period of 2016-17.

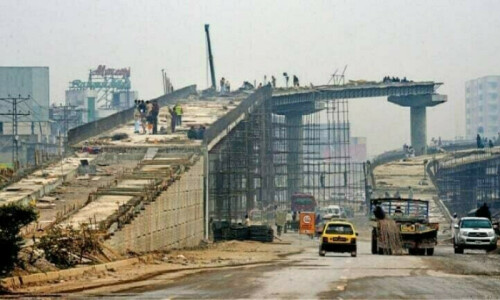

Similarly, iron and steel with a weight of 5.39 pc grew by 30.85pc compared to 16.15pc in the same period of FY17. The production of iron and steel has increased despite zero production from Pakistan Steel.

Published in Dawn, May 5th, 2018

Dear visitor, the comments section is undergoing an overhaul and will return soon.