KARACHI: The Federal Investigation Agency on Friday detained Pakistan Stock Exchange chairman and Summit Bank vice chairman Hussain Lawai, who is widely believed to be close to former president Asif Ali Zardari, and assistant vice president of Sindh Bank Mr Mukhtiar along with two other bankers for interrogation in a money laundering case, sources said.

Mr Lawai and the other bankers were accused of facilitating opening of 29 ‘fake’ accounts in the Summit Bank, Sindh Bank and United Bank Limited, where ‘beneficiaries of the Sindh government’ had deposited Rs35 billion that was subsequently transferred to different accounts including one allegedly belonging to an Arab national, Nasser Abdulla Hussain Lootah, who is the chairman of the Summit Bank’s board of directors, added the sources familiar with the case.

An FIA official, who wished not to be identified, said: “An FIR has not been registered against any of them so far to formally arrest them, as the bankers are still being interrogated.”

To personally supervise the probe and evaluate the inquiry, a special team, led by the FIA’s additional director general and law director, have rushed to Karachi from Islamabad after the Supreme Court of Pakistan took a suo motu notice.

The FIA team on Friday called Mr Lawai to record his statement in the case.

FIA investigates Rs35 billion transactions in 29 ‘fake’ accounts

In all, 29 accounts were opened in the name of seven people, including a woman, the sources said, adding that 18 to 19 of the ‘fake’ accounts were opened in the Summit Bank alone. The sources said the financial monitoring unit of the State Bank of Pakistan alerted the FIA about ‘fictitious’ transactions in the banks. Subsequently, the FIA interrogated four of the seven persons in whose name the 29 accounts were opened. All the four people, including the woman, expressed their ignorance about the transactions and recorded their statements before the magistrate concerned.

The FIA also interrogated the Summit Bank branch manager who claimed that he had opened the accounts on the instructions of then president of the bank Mr Lawai.

Separately, the sources said, the FIA called three other officials of the banks to record their statements in the case.

The FIA sources explained that mainly contractors of the Sindh government and a property tycoon had deposited Rs35 billion in those bank accounts from which money was transferred to the accounts maintained by a conglomerate of noted businessmen and a politician.

Besides, the sources added, around Rs7 billion of the total amount was transferred to the account of an Arab national, Mr Lootah, who is vice chairman of the Summit Bank.

The sources said the money was transferred in the name of the Arab national’s account in order to show equity and avoid possible suspension of bank’s licence by the State Bank of Pakistan.

An FIA official told Dawn on condition of anonymity that the role of SBP’s relevant unit was less than satisfactory in the money laundering case but he was not sure if the FIA would look into it at any stage.

He said the FIA detained Mr Lawai and three other bankers under Section 5 (2) of FIA Act, which empowered the federal body to detain any suspect for inquiry for 24 hours.

The sources said that most of these ‘fake’ accounts were opened in the end of 2014 and early 2015. They were subsequently closed in the year 2015.

Most of the accounts were maintained in UBL’s SMCHS Branch, Summit Bank’s Khayaban-i-Tanzeem DHA branch and I.I. Chundrigar Road and Sindh Bank’s Gol Market, Nazimabad branch.

The FIA sources said the business address in the most of the accounts were of Abdullah Haroon Road, Karachi. Besides, they added, counter-parties of the most of the accounts were found to be common.

Despite such high turnovers in the account, most of the account holders were not found on the active taxpayers’ list, triggering the suspicions about these transactions which were in violation of Section 67 of Anti-Money Laundering Act of 2010.

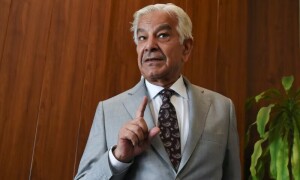

Who is Hussain Lawai?

Mr Lawai, who is currently the vice chairman of the Summit Bank, also served as its president from 2008 to 2016. He previously served as the Central Depository Company (CDC) chairman as well.

He held the position of president and CEO at the MCB Bank and holds the distinction of establishing the Faysal Islamic Bank, Pakistan branches; the first Islamic Shariah Compliant Bank (presently known as Faysal Bank Limited). He also served as general manager at Emirates NBD Bank for Pakistan and Far East.

Currently, Mr Lawai is also on the board of directors of Wyeth Pakistan Ltd, GlaxoSmithKline Pakistan Ltd, GlaxoSmithKline Consumer Healthcare Pakistan Ltd and The Searle Company Ltd. He also serves on the Board of Governors of Karachi Grammar School and Virtual University of Pakistan.

He also served on the board of directors of Pakistan International Airlines and State Life Insurance Corporation of Pakistan.

He did his MBA from the Institute of Business Administration (IBA), Karachi.

Correction: An earlier version of the story mentioned Hussain Lawai as the current Central Depository Company (CDC) chairman, instead of former. The error is regretted.

Published in Dawn, July 7th, 2018