The economic quagmire that Pakistan faces today has its roots in two structural problems. One, the government spends more than it collects in taxes, thus failing to balance its books every year. It borrows to bridge that revenue gap, which restricts its ability to spend on human development.

Two, it imports way more than it exports, which widens the trade deficit every year. It borrows more dollars from foreign lenders to pay for these imports, which further increases the debt burden and depletes foreign exchange reserves.

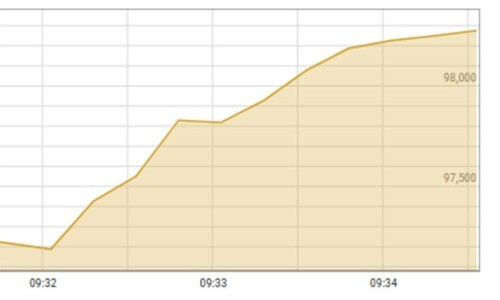

These charts show all that is wrong with our fiscal management and external sector.

Every new government sets out to be fiscally responsible at the beginning of its term. But the reality sinks in as soon as it goes to the IMF to overcome a balance-of-payments crisis. In following years, political compulsions and weak fiscal control deplete foreign exchange reserves and wreck the economic train. The new government comes in, and the cycle continues.

Pakistan’s fiscal deficit was 6.6 per cent of GDP in 2017-18. This means the ‘fiscal slippage’ was 2.5pc of GDP as the government had originally planned to restrict the gap between revenue and spending to 4.1pc. According to a finance ministry document prepared at the end of the interim setup in mid-August, this reflects primarily the impact of the revenue shortfall, despite the additional Rs90 billion tax money generated through the amnesty scheme, and overspending of Rs40bn.

Although the share of taxes as a percentage of GDP has grown over the last decade, its current level remains demonstrably insufficient. In fact, the actual tax collection is only about half the country’s tax capacity, which the IMF estimates to be 22.3pc of GDP.

Published in Dawn, The Business and Finance Weekly, August 27th, 2018