THE latest round of interest rate hikes administered by the State Bank speaks of ominous trends beneath the surface.

This is the second large hike since the latest round of monetary tightening began earlier this year, coming in at 1pc. In announcing it, the State Bank pointed to the growth of underlying inflationary pressures as well as the fiscal and current account deficits as key emerging challenges that have yet to be tackled in a convincing way.

Overall, economic activity is expected to decelerate this fiscal year, the monetary policy statement said, putting the growth forecast at 5pc.

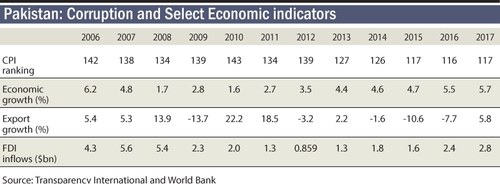

Only a few days ago, the Asian Development Bank forecast 4.8pc growth, whereas the target was 6.2pc. Clearly, a rapid deceleration in growth is coming our way.

The State Bank’s action shows that the underlying challenges that the economy faces are far from receding; in fact, they are growing.

Between July and September, this is the second downward revision of the State Bank’s forecast for economic growth, and the second rise in the forecast for core inflation.

Not only that, the current account deficit continued to rise in the first two months of the fiscal year, despite the strong growth in workers’ remittances and exports. In large measure, the difficulties on the external account front are the product of rising oil prices, but equally significantly, they are the result of pressing ahead with a type of growth that the economy was unable to afford.

The net result is a decline in foreign reserves by $800m compared to the first two months of the last fiscal year.

These are worrying trends because they come after successive rounds of exchange rate depreciation as well as interest rate hikes.

The full scale of the adjustment that the economy needs to undertake, therefore, is far larger than anything imagined thus far.

Finance Minister Asad Umar has his job cut out for him, since such adjustments always exact a steep political cost, and it is not unusual for political governments to be reluctant to undertake them.

The imbalances that plague the economy may well be the handiwork of the previous government’s economic management that gave us a short-lived, unsustainable spurt of growth that is now unravelling under the weight of its own imbalances.

But the job of stabilising the situation belongs squarely to this government, and more specifically to Mr Umar whose finance act is a small step in that direction — although given the scale of the imbalances, grossly inadequate.

Far more will be required in the days to come. The job includes not only charting a difficult course into the future, but persuading those around him, including his colleagues and stakeholders in the economy, that the bitter pill is the only one on the menu.

Published in Dawn, September 30th, 2018