• Govt agrees to increase energy prices, generate more taxes and allow independence to State Bank

• Hafeez says IMF facility will help revive flow of $2-3 billion from World Bank, ADB

ISLAMABAD: Loaded with upfront policy actions worth over Rs700 billion, Pakistan and the International Monetary Fund (IMF) finally reached a staff level agreement on Sunday about a $6bn bailout to implement an “ambitious structural reform agenda” over a period of 39 months.

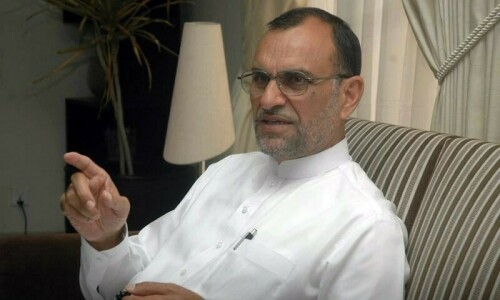

“After negotiations over many months, Pakistan and the IMF have reached a staff level agreement that would be approved by the IMF executive board,” announced Dr Abdul Hafeez Shaikh, the Prime Minister’s adviser on Finance and Revenue, on national television.

This was simultaneously confirmed by the IMF in a statement that linked the agreement to “timely implementation of prior actions”.

The IMF said the “forthcoming budget for FY2019-20 is a first critical step in the authorities’ fiscal strategy” that will aim for a primary deficit of 0.6pc of GDP supported by tax policy revenue mobilisation measures to eliminate exemptions, curtail special treatments and improve tax administration.

That would mean the government would have to generate additional revenues of about Rs600bn (1.3pc of GDP) so that primary deficit comes down from 1.9pc at present to 0.6pc of GDP.

The successful conclusion of an agreement on the Extended Fund Facility (EFF) is expected to clear the uncertainty prevailing in the markets and to revive investor confidence.

Under the programme, the government agreed to increase energy prices, generate more taxes, introduce a market determined exchange rate, allow full operational independence to the State Bank and focus on inflation instead of growth.

The provinces will have to create more cash surpluses to support the federal government’s fiscal stability.

A government official told Dawn that in the first year beginning on July 1, Pakistan will have to generate additional tax revenues of about Rs600bn, raise about Rs100bn from higher-end power consumers, privatise at least two power LNG plants worth over Rs280bn ($2b) and stop haemorrhaging of other public sector entities. These three big agenda items would provide about Rs1 trillion fiscal adjustment during the first year, including a one-time recovery of about Rs280bn from sale of two LNG plants in Punjab.

Energy Minister Omar Ayub Khan told Dawn that Rs98bn additional cost of power would be recovered from consumers at a rate of under Re1 per unit increase in tariff for consumers using more than 300 units per month. He said the government took a firm stand to protect low-end consumers using less than 300 units per month for whom an additional subsidy of Rs52bn would be earmarked in the budget, raising the total power sector subsidy to Rs216bn.

He said the flow of circular debt would be brought down to zero by Dec 31, 2020 while the existing stock of about Rs606bn would be reduced through sale of two LNG power plants and issuance of more bonds.

Dr Shaikh said IMF programme would also help revive flow of $2-3bn per annum from the World Bank and the Asian Development Bank, improve Pakistan’s debt situation and sending a positive signal to world markets.

Under the programme, Pakistan will have to adjust its expenditure in keeping with its capacity, put an end to continuous bleeding of public sector enterprises, reduce subsidies to the rich, generate more taxes from the affluent. “All these things are in the country’s interest and should be done with or without an IMF programme,” Dr Shaikh said.

Structural reforms

The adviser said the government would have to implement long overdue structural reforms to put the country on a stable path of growth and prosperity and give a message of fiscal discipline to the world. He agreed that the package would have some costs and prices of some items would have to be improved in a manner that minimum burden reached the people.

For example, he said energy rates would have to be pushed up, but it had been ensured that 75 percent consumers who use under 300 units per month remained unaffected. An additional subsidy would be provided in the budget to this end.

Likewise, social safety nets under schemes like the Benazir Income Support Programme and Ehsas would be improved.

The IMF said the staff level agreement on economic policies supported by a 39-month $6bn EFF was “subject to IMF management approval and to approval by the Executive Board, subject to the timely implementation of prior actions and confirmation of international partners’ financial commitments”.

It said the programme will support the authorities’ strategy for stronger and more inclusive growth by reducing domestic and external imbalances, removing impediments to growth, increasing transparency, and strengthening social spending. “An ambitious structural reform agenda will supplement economic policies to rekindle economic growth and improve living standards”, the IMF said but warned that financing support from Pakistan’s international partners will be critical to support the authorities’ adjustment efforts and ensure that the medium-term programme objectives can be achieved.

“Decisive policies and reforms, together with significant external financing are necessary to reduce vulnerabilities faster, increase confidence, and put the economy back on a sustainable growth path, with stronger private sector activity and job creation”, the IMF said.

A comprehensive plan for cost-recovery in the energy sectors and state-owned enterprises will help eliminate or reduce the quasi-fiscal deficit that drains scarce government resources. “Provinces are committed to contribute to these efforts by better aligning their fiscal objectives with those of the federal government”.

“An ambitious structural reform agenda will supplement economic policies to rekindle economic growth and improve living standards. Priority areas include improving the management of public enterprises, strengthening institutions and governance, continuing anti-money laundering and combating the financing of terrorism efforts, creating a more favorable business environment, and facilitating trade. To improve fiscal management the authorities will engage provincial governments on exploring options to rebalance current arrangements in the context of the forthcoming National Financial Commission”, the IMF said.

Published in Dawn, May 13th, 2019