KARACHI: The stunning victory at the stock market extended into the fourth day where the KSE-100 index cumulatively gained 2,414 points (7.13 per cent).

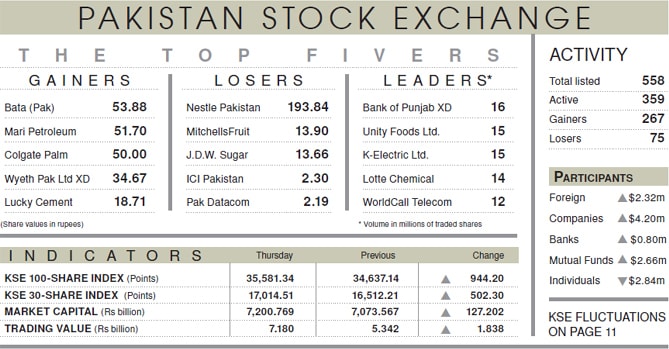

On Thursday, the KSE-100 index rose 944.20 points (2.73pc) and closed at 35,581.34, taking the last two sessions’ collective gains at 6.3pc, which marked the highest two-day gains in a decade.

Investors rushed for anticipatory buying before the launch of proposed government guaranteed market support fund, the modalities for which are being drawn up on the lines of State Enterprise Fund established in 2009.

Investors were also encouraged by the recent MSCI review that kept Pakistan intact in the Emerging Market and the approval of oil deferred payment facility from Saudi Arabia.

Although uncertainties on the further rupee devaluation, contents of the budget 2020 and interest rate rise remain, participants eyed low valuations and driven by the Fear of Missing Out (FOMO) went into cherry picking across the sectors.

On Thursday, companies were major buyers of stocks worth $4.22 million, while mutual funds, which have been the main spoilers of the market, reverted to buying stocks valued at $0.6m.

Volumes soared to 39 sessions high, increasing 12pc over the previous day to 227.7m shares. Traded value surged 34pc to $47.3m.

Stocks that contributed significantly to the volumes included Bank of Punjab, Unity Foods, K Electric, Lotte Chemical and Worldcall Telecom, which formed 32pc of total volumes.

Cement sector continued to the intraday gains making contribution of 100 points to the index and with heavy volumes. D. G. Khan Cement, Lucky Cement, Maple Leaf Cement Factory, Fauji Cement Company Ltd and Cherat Cement Company all closed at their upper circuits.

Banking sector also rose 247 points as investors were encouraged by the hike in interest rates. National Bank of Pakistan hit the upper lock, while Bank Al Habib Ltd, Bank Al Falah, United Bank Ltd and Habib Bank Ltd were the major gainers in the sector.

It was followed by fertiliser and exploration and production sectors which cumulatively added 327 points to the index.

Published in Dawn, May 24th, 2019