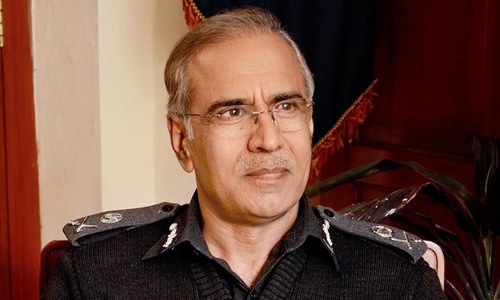

ISLAMABAD: The law ministry removed Mushtaq Ahmed Sukhera from the post of Federal Tax Ombudsman (FTO) by de-notifying his appointment on Thursday.

A notification issued by the ministry said: “In pursuance of President Secretariat (Public) U.O. No 5 (106)/L&J/Dir (Coord-V)/2019 dated June 03, 2019, Ministry of Law and Justice Notification of even number dated August 31, 2018 regarding appointment of Mr Mushtaq Ahmed Sukhera (retired PSP/BS-22) as the Federal Tax Ombudsman is hereby withdrawn ab initio.”

According to the Federal Tax Ombudsman Ordinance 2000, the president appoints FTO for a period of four years.

Sources said that Mr Sukhera’s involvement in the incident in Lahore’s Model Town, in which over a dozen people were killed, led to his removal from the position.

His involvement in Model Town incident and frequent rulings against FBR officers led to move, say sources

They said that he was named in a complaint filed by the Pakistan Awami Tehreek (PAT) against top leaders of the Pakistan Muslim League-Nawaz and senior police officials.

Last year an anti-terrorism court indicted Mr Sukhera and 115 other police officials in connection with their alleged role in the June 2014 Model Town incident in which 14 PAT workers were killed.

However, the sources said it was not the Model Town case alone which led to Mr Sukhera’s sacking; his frequent rulings against officers of the Federal Board of Revenue (FBR) also played a part.

The Federal Tax Ombudsman Ordinance 2002 empowered him to proceed on a “complaint by any aggrieved person, or on a reference by the president, the Senate or the National Assembly, as the case may be, or on a motion of the Supreme Court or a High Court made during the course of any proceedings before it or of his own motion, investigate any allegation of maladministration on the part of the Revenue Division or any Tax Employee”.

They said some senior officials of the FBR had submitted a representation against Mr Sukhera to President Dr Arif Alvi.

Earlier this year the secretary for Inland Revenue wrote a letter to the tax ombudsman and said the latter was exceeding his jurisdiction.

The letter available with Dawn said: “(The) FTO does not have jurisdiction to investigate or inquire into matters in respect of which legal remedies of appeal/review/revision are available.”

The letter insisted that FBR had “comprehensive and exhaustive mechanisms for redressal of complaints made by a taxpayer against any employee of the FBR”.

“In view of the special remedies available with the FBR, the general remedies of FTO cannot be availed,” the letter added.

Published in Dawn, June 14th, 2019