KARACHI: Fearful of an anti-market budget that was thought to slap heavy taxation, the market began the outgoing week with all-round selling as index lost 938 points, the largest single-day decline for CY19.

But to everyone’s surprise, budgetary measures were not quite as harsh as expected and the severity of new tax proposals was considered to be lower than expectations for sectors including fertiliser and banks

The analysts’ initial impressions of a neutral-to-negative budget changed slightly for the better with the last three sessions of the week witnessing a mini-rally. All in all, the KSE-100 index posted a minor gain of 68 points (0.19 per cent) and settled at 35,573.

Many market watchers continued to term the budget as negative that would escalate inflation. That was made worse by the free fall of the rupee and the growing noise on the political front. However, talks of the activation of market support fund towards the end helped lift investor sentiments.

Key highlights of Budget’19 from market’s standpoint included continuation of capital gains tax at 15pc, freezing of corporate tax rate at the current level of 29pc, abolishment of tax credit for BMR investment, increased tax rates on profit on debt and bringing of capital gains on property sale under normal tax regime. Analysts believed that the latter two measures were positive for the market as investors may switch from fixed income securities and property to equities.

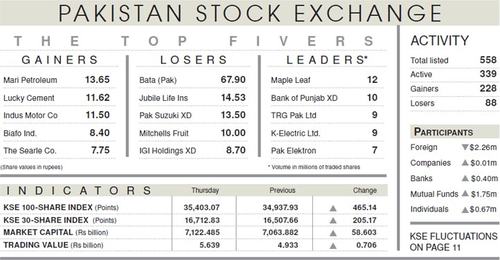

Foreign selling continued, clocking in at $4.9 million compared to a net sell of $2.3m last week. Major selling was witnessed in exploration and production at $6.9m while banks witnessed inflows of $3.3m. Amongst domestic investors, individuals emerged as major buyers of equity worth $2.8m and bank bought shares valued at $2.3m.

The volume remained on the lower side, down 13pc over the earlier week to 136m shares while traded value also dropped 23pc to $34m. Leaders were K-Electric witnessing change of hands in 47.5m shares, followed by Maple Leaf at 43.5m, Bank of Punjab 42.8m and TRG Pakistan 37.5m.

Sector-wise, fertilisers were principal gainers of 181 points, cement 65 points, pharmaceutical 33 points and technology and communication 25 points. Leading gainers were Fauji fertiliser, up 8.98pc, Searle Company 11.97pc and Engro Corporation 2pc. Engro and Oil and Gas Development Company also contributed to the index upside.

Among scrips, other major gainers were Hira Textile up 68pc on the back of possible acquisition of its associate company Hira Terry (47pc owned) by Feroze 1888 Mills. Similarly, Arif Habib Corp and Netsol Technologies gained 13pc due to buyback plan.

Going forward, with clarity emerging on the budgetary proposals, investors are likely to settle down to a better assessment of the market direction in the future. The end of the financial year 2018-19 in sight, investors would watch out keenly for the last quarter results.

Moreover, market would also expect the activation of market support fund which could help gather further ground. However, two key negatives would be the volatility in the rupee-dollar parity as the local currency slipped by as much as 4.9pc in the outgoing week. The week may also be hostage to heightened political noise as proceedings against prime political figures could cause nervousness among investors.

Published in Dawn, June 16th, 2019

Dear visitor, the comments section is undergoing an overhaul and will return soon.