KARACHI: The stock market was a picture of despondency on Thursday where the absence of investors saw the market volume at seven-year low and the KSE-100 index claw up by 35.35 points (0.10 per cent) to close at 33,875.40.

The index opened in the positive and rose to intraday high by 118 points but soon succumbed to selling pressure which sent it sinking to intraday low by 115 points as investors remained undecided on lack of triggers and market-moving news.

Traders preferred to stay on the sidelines despite the finance minister’s claim of the launch of market support fund in 5-6 days. “Disbursement of funds at a moment when the International Monetary Fund has imposed a ceiling on government guarantees seems unlikely,” said a senior participant.

The uncertainty over the Fund along with past fluctuating exchange rates and heating up of temperature on the political front drove away investors to the safety of currently high-yielding fixed income securities.

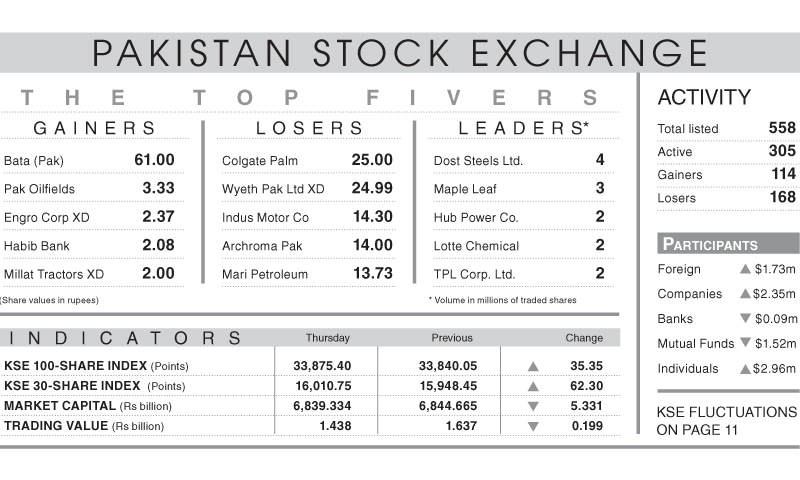

The volume decreased by 3pc to 39.5 million, as against 40.6m while traded value also declined by 12.2pc to $9.1m from $10.3m. Stocks that contributed significantly included Dost Steels, Maple Leaf, Hub Power, Lotte Chemical and TPL, which formed 34pc of total volume.

Foreign inflows continued with net purchases of $1.73m worth stocks; companies and individuals were also net buyers, but mutual funds reduced their positions with sale of stocks valued at $1.52m.

Sector-wise, mixed sentiments were witnessed in the banks where Habib and United gained while Meezan and Allied closed in the red. Among cement, Maple Leaf, Lucky, DG Khan and Pioneer edged higher.

Overall, stocks that contributed positively were Habib Bank, increasing by 33 points, Engro Corporation 16 points, United 14 points, Pakistan Oilfields 9 points and MCB 8 points. On the flip side, Mari Petroleum, lower by 7 points, National Foods 5 points, Meezan Bank 5 points, Indus Motor 4 points and Habib Metro 4 points were negative contributors.

Published in Dawn, July 12th, 2019