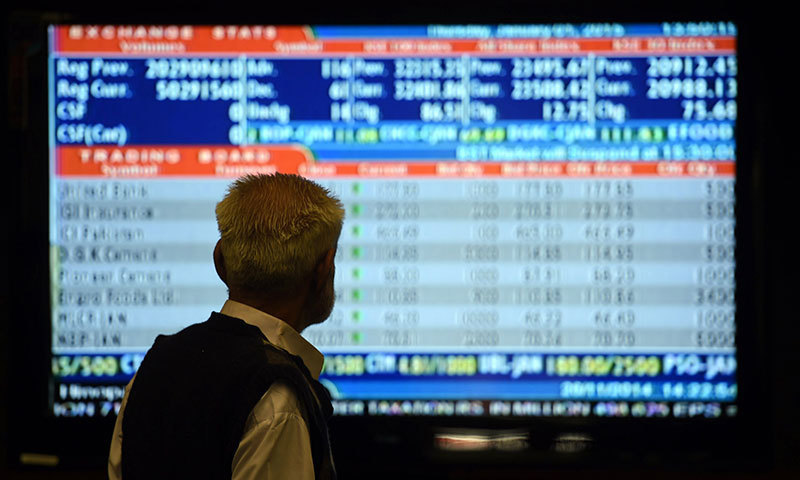

KARACHI: The KSE-100 index suffered a massive decline of 723 points (down 2.33 per cent) on Wednesday to revert the benchmark back to March 2015 level and close at 30,277.

The markets yielded to the ongoing uncertainty on the US-China trade war tensions along with the rising geopolitical insecurity over the Kashmir issue as the National Security Committee decided to downgrade diplomatic relations and review bilateral trade arrangements with India.

Moreover, on the domestic front, the National Accountability Bureau arrested former finance minister Miftah Ismail after the Islamabad High Court rejected his request to extend interim bail in the LNG import case.

The volume jumped up 20pc to 65 million shares from 54m while traded value edged up by 3pc to $17.4m, as against $16.8m the previous day. Stocks that contributed significantly included K-Electric, Maple Leaf Cement, Lotte Chemical, TRG Pakistan and Hascol Petroleum, which made up 27pc of total turnover.

Local sell-off clocked in at $0.46m as mutual funds sold equity worth $3.68m which was picked up by individuals that bought shares valued at $3m. However, foreign investors emerged as net buyers increasing their positions by $0.46m.

Sector-wise, commercial banks led the decline on the index as financials landed in red despite Habib and United Bank announcing financial results in line with market expectations.

Stocks that contributed negatively were Oil and Gas Development Company, losing 70 points, UBL 55 points, Hub Power Company five points, Pakistan Petroleum 51 points and Engro Corporation 45 points.

On the flip side, gainers were Dawood Hercules, adding nine points, Shifa Int. Hospitals five points, Kohinoor Textile Mills Ltd three points, Fauji Fertiliser Bin Qasim Ltd three points and Services Industries two points.

Published in Dawn, August 8th, 2019