ISLAMABAD: The government on Thursday increased the prices of three major petroleum products — high speed diesel (HSD), petrol and liquefied petroleum gas (LPG) — for the month of November to generate an additional revenue of about Rs700 million.

On the other hand, it reduced the prices of two comparatively insignificant products — kerosene and light diesel oil (LDO) — as recommended by the Oil and Gas Regulatory Auhtority (Ogra).

According to a notification issued by Ministry of Finance, the ex-depot price of petrol has been increased by Re1 per litre and that of HSD by 27 paisa per litre. However, the ex-depot price of kerosene and LDO has been reduced by Rs2.39 and Rs6.56 per litre, respectively.

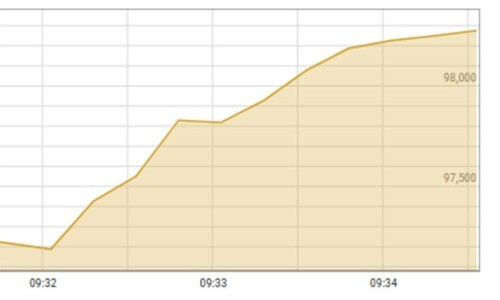

Consequently, the ex-depot price of HSD has shot up to Rs127.41 per litre from Rs127.14 per litre in October, showing an increase of 0.2 per cent (27 paisa). Likewise, the ex-depot price of petrol has jumped to Rs114.24 per litre from the existing rate of Rs113.24 per litre, up by 0.88pc (Re1).

On the other hand, the ex-depot price of LDO has been fixed at Rs85.33 per litre, instead of the existing rate of Rs91.89 per litre, showing a reduction of 7.13pc or Rs6.56. Similarly, the ex-depot price of kerosene has risen to Rs97.18 per litre from Rs99.57 per litre, down by 2.4pc (Rs2.39).

Besides, the price of LPG (liquefied petroleum gas) has also been increased by Rs20 per 11kg domestic cylinder to Rs1,495 from the existing rate of Rs1,475.

In recent months, the government has already increased general sales tax (GST) on all petroleum products to the standard rate of 17pc to generate additional revenue. Until January this year, the government was charging 0.5pc GST on LDO, 2pc on kerosene, 8pc on petrol and 13pc on HSD.

Besides the 17pc GST, the government has more than doubled the rate of petroleum levy on HSD in recent months, to Rs21 per litre from Rs8 per litre, while levy on petrol has also been increased by 50pc to Rs17.20 per litre from Rs10 per litre. The levy on kerosene oil and LDO is currently being charged at the rate of about Rs5 per litre.

Over the last few months, the government has started increasing petroleum levy rates to partially recoup a major revenue shortfall faced by the Federal Board of Revenue in the first quarter of the current fiscal. The levy remains in the federal kitty unlike GST that goes to the divisible pool taxes, enabling the provinces to acquire about 57pc share.

Petrol and HSD are two major products that generate most of revenue for the government because of their massive and yet growing consumption. Total HSD sales are touching 800,000 tonnes per month against monthly consumption of around 700,000 tonnes of petrol. The sales of kerosene and LDO are generally less than 10,000 tonnes per month.

Last month, the government had kept the petroleum prices unchanged to earn windfall revenue of over Rs4.5 billion despite up to 2.6pc cut worked out by Ogra for October. The government had instead increased the petroleum levy on HSD and petrol.

Published in Dawn, November 1st, 2019

Dear visitor, the comments section is undergoing an overhaul and will return soon.