KARACHI: The stock market witnessed another spectacular rally in the outgoing week with the benchmark KSE-100 index up by 1,606 points (4.5 per cent) and closing seen above the 37,000 resistance level at 37,584.

Incidentally the market performance matched the earlier week when the index had propelled by almost the same points and percentage (1,601 points and 4.7pc). The persistent upside in Pakistan’s equity market was largely the result of economic stabilisation as evidenced by improving economic indicators.

October’s trade deficit showed decline of 29pc while State Bank reserves rose by 0.5pc. Positive sentiments were further reinforced by International Monetary Fund expressing satisfaction over the country’s progress towards achieving all its economic targets.

Foreign investment in government-backed treasury bills at $722 million since the beginning of FY20, attributable to waning concerns on the economic front had kept the exchange rate parity stable. On the political front, the culmination of sit-in by JUI (F) gave confidence to investors though the unsolved issue of the removal of former PM’s name from the exit control list to proceed to London kept investors cautious.

Foreign investors, mainly corporates, bought stocks worth $4.2m in the outgoing week against net purchases of $4.5m the preceding week. Inflow was witnessed in fertiliser at $5.1m and commercial banks $3.8m.

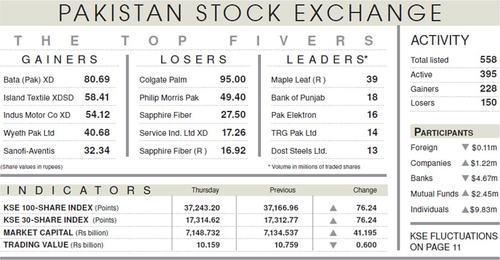

On the domestic front, individuals were the lead buyers of shares valued at $16.8m while selling was reported by banks/DFIs worth $18.8m and insurance companies $9.6m. Average volume settled higher by 21pc to 311m shares while mean traded value clocked in at $64m, up by 17pc.

Sector-wise, auto managed to outperform the broader market, providing a return of 11.4pc as it was encouraged by higher than expected earnings of Honda Car in its quarterly accounts released during the week.

Positive sentiments in the sector were likely due to stability of the rupee, supporting the sector’s margins and profitability.

Meanwhile, fertilisers provided a return of 6pc as investors were likely building positions in the high-yield sector in view of the eventual monetary easing. Commercial banks contributed 430 points to the index, power generation and distribution 203 points, cement 133 points, exploration and production 127 points, and oil marketing companies 101 points while declines were made by tobacco, lower by 33 points.

Among scrips, major contribution to index upside came from Hub Power, increasing by 9.64pc, Habib Bank 4.69pc, Bank AL Habib 8.40pc, Engro Corporation 2.51pc and TRG Pakistan 26.13pc.

Going forward, the market is expected to see a temporary spell of consolidation, following which the index is expected to continue its upsurge led by improvement in the macroeconomic indicators.

Moreover, participation by foreign and local investors ought to keep sentiments upbeat.

Participants would be keeping eye on the upcoming monetary policy to be announced at the end of the month where many analysts expect slight cut in interest rate in line with the government’s stance of promoting growth in economy.

Published in Dawn, November 17th, 2019