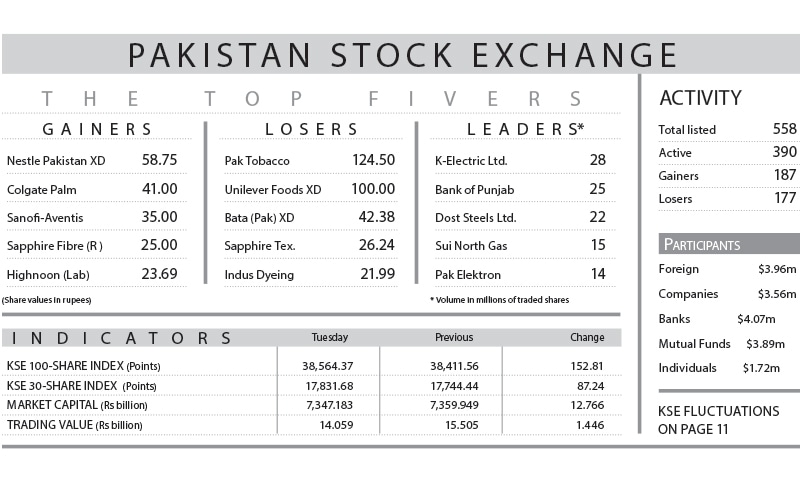

KARACHI: Stocks extended gains for another day with the KSE-100 index up by 152.81 points (0.40 per cent) to close at 38,564.37.

The index has recovered 9,894 points (35pc) so far from its recent lows of 28,670 points recorded in August. It galvanised to intraday high by 500 points before succumbing to profit-taking in cements, steel and banks and dropping in the red by 18 points, before finally bouncing back.

Risk-averse institutional investors were inclined to stay out given the consistent buying spree over the last several weeks, but they were also troubled by the fear of missing out.

Foreigners who have been supporting the current rally bought stocks worth $3.96 million, raising the year-to-date purchases at substantial $74.82m. Mutual funds also built positions in equity worth $3.89m while individuals mainly bought under-valued second-tier shares of $1.72m. On Tuesday, banks, companies and insurance companies were net sellers.

Investors were enthused by the news of improvement on the economic side where Pakistan’s current account recorded a surplus of $99m in October after a gap of four years. The market is awaiting the State Bank’s monetary policy announcement on Nov 22.

The volume declined 17pc to 384.8m shares, from 466.1m while traded value fell 9pc to reach $90.4m, as against $99.8m.

Key stocks that sustained selling pressure included DG Khan, Maple Leaf, Fauji Cement and largely the steel sector, where Mughal saw trading at lower circuit.

Major contribution to the upside came from Hub Power, higher by 5pc, Pakistan State Oil 3.80pc, Dawood Hercules 2.61pc, Sui Northern Gas 5pc and Fauji Fertiliser 0.92pc, which was partially offset by losses in Pakistan Tobacco, down 4.98pc, Engro Corporation 1.11pc, United Bank 1.44pc, Bank Al Habib 1.42pc and Pakistan Oilfields 0.94pc.

Published in Dawn, November 20th, 2019