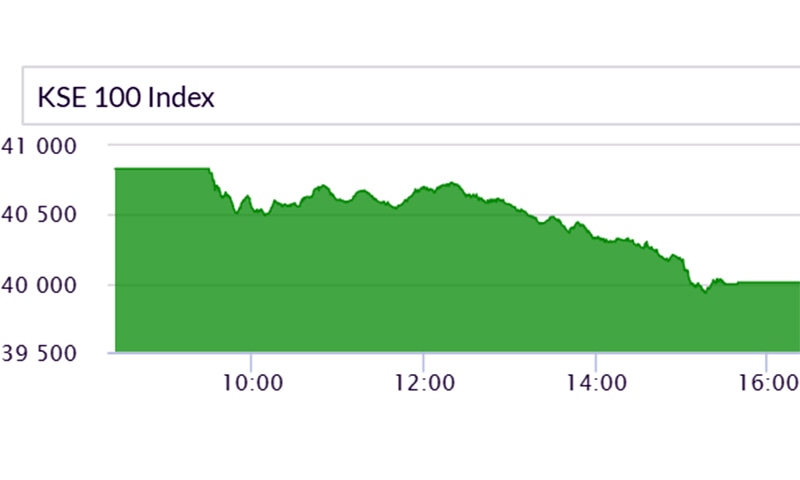

The Pakistan Stock Exchange (PSX) on Monday declined sharply, with the benchmark KSE-100 Index shedding 824 points to close at 40,008, down 2 per cent.

The market opened at 40,833 points, which remained the day's high, and went down to 39,931 points before making a slight recovery before the closing bell.

As many as 104.3 million shares of benchmark companies worth Rs5.7 billion changed hands during the session. Out of the total 332 symbols traded, 275 declined, 44 advanced and 13 remained unchanged.

According to a Topline Securities report, the benchmark index barely managed to maintain the 40,000-points level as the rollover week had started.

"Negative sentiments were witnessed across the board," the report said, adding that top losers of the day were HBL (down 93 points), followed by PPL (down 91 points), HUBC (down 54 points) and DAWH (down 51 points).

"WTL was the volume leader as it recorded volume of 14m shares, followed by HASCOLR1 and UNITY which cumulatively added 25m shares to the total volume," it added.

Analysts say the bearish trend continued with full force on the back of multiple factors, including profit taking by both local and foreign investors.

Senior analyst Ahsan Mehanti said "redemption call by mutual funds coupled with profit taking by foreigners at the end of the quarter" was responsible for the bloodbath.

A JS Global report said, "Market remained lackluster throughout the trading session after a hectic sell-off being observed."

"Moreover on the political front Indian and Pakistani troops exchanged fire in some areas along the restive Line of Control (LoC) in the disputed Himalayan region of Kashmir adding more turbulence towards the red index," it added.

JS Global expects the market to remain lackluster due to the rollover week, and recommends any major dips in the market be taken as an opportunity to accumulate value stocks.