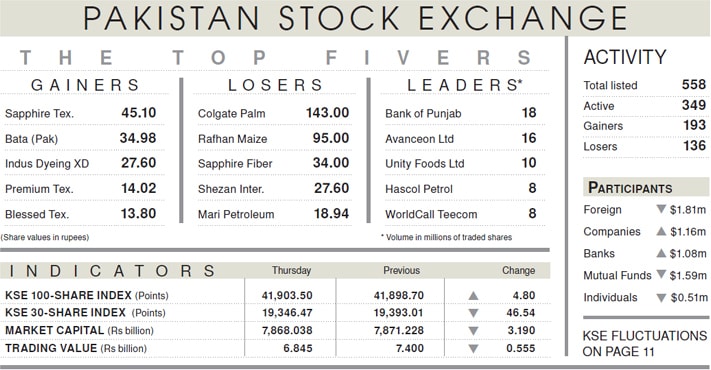

KARACHI: Stocks closed flat on Thursday where the KSE-100 index crawled up by a mere 4.80 points (0.01 per cent) and settled at 41,903.50 with the market capitalisation showing a slight drop of Rs3 billion.

The lacklustre activity was partly thanks to fall in shares of exploration and production sector because of the dip in oil prices. Selling pressure in rollover week also did not allow the bullish breakout.

But the Economic Coordination Committee’s decision to delay proposed gas tariffs improved investors’ sentiments that saw the index oscillate between the intraday high and low by 84 and 351 points.

While the KSE-100 remained about unchanged, the KSE-30 index stepped down by 46.54 points amid thin trade led by banking and cement stocks as investors synchronised their activity on declaration of financial results.

With the weekend ahead, investors avoided taking long positions.

Uncertainty surrounding the Financial Action Task Force grey list exclusion in Paris review next month also kept buyers on the sidelines. Analyst Ahsan Mehanti observed that upbeat data on FDIs in Jul-Dec’19, foreign inflows, rupee stability and investor speculations over Rs150bn target in state-owned enterprises privatisation program played a catalyst role in positive close in the earnings season.

The volume declined 18pc over the previous day to 162.2m shares while traded value also decreased by 8pc to reach $44.3 million. Stocks that contributed significantly included Bank of Punjab, Avanceon Ltd, Unity Foods, Hascol Petroleum and Worldcall Telecom, which formed 37pc of total turnover.

Sector-wise, cement and fertiliser largely traded positive while banking and exploration and production again faced selling pressure almost across the board.

Scrips that made major contribution to the index included Dawood Hercules, higher by 4.98pc, Lucky Cement 2.37pc, Engro Corporation 1.09pc, Habib Bank 0.49pc and Systems Ltd 5.49pc. Those were largely offset by declines in Hub Power, down 1.42pc, MCB 1.15pc, United Bank 1.06pc, Colgate-Palmolive Pakistan 5.50pc and Bank Al Habib 1.29pc.

Published in Dawn, January 31st, 2020