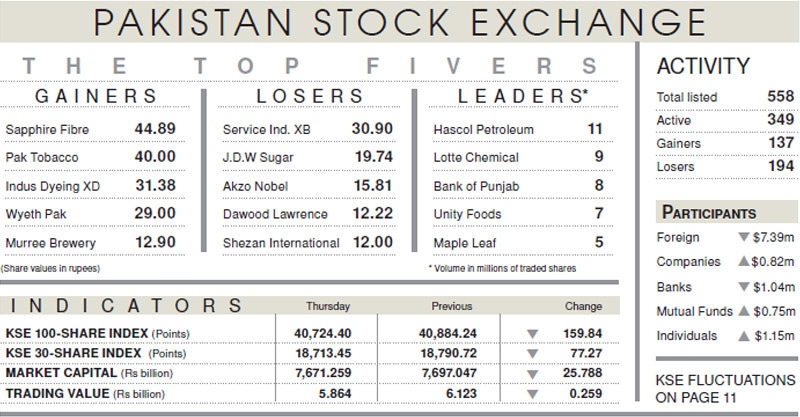

KARACHI: Stocks retreated on Thursday with the KSE-100 index declining by 159.84 points (0.39 per cent) to close at 40,724.40.

Market opened on a positive note encouraged by the slight recovery in global equities. The index climbed to intraday high by 279 points as uptick in international crude prices prompted investors to build fresh positions in the oil and gas sector.

But as the day wore off, investors’ gaze shifted to the macro front and speculation over the International Monetary Fund’s second quarterly review. Reports suggesting intense debate between the IMF and the Federal Board of Revenue over setting a lower collection target where the former proposed new taxes to meet projected amounts but were met with resistance by the FBR which argued that it would fuel inflation.

Investors also kept an eye on the world worries over the outbreak of corona virus. Sentiments were also dampened by the Pakistan Investment Bond’s auction where cut-off yields on three-, five- and 10-year bonds increased by 30 basis points, 21bps and 10bps, respectively.

Already jittered by the record high January inflation figures, investors opted to take profit led by foreigners which sold shares worth $7.39 million. The index shed all of the early gains and dipped into the red to touch intraday low by 160 points. Insurance companies and individuals picked up shares at lower levels.

The volume declined 13pc to 127.8m shares from 146.2m while traded value edged lower by 4pc to $38m. Stocks that contributed significantly included Hascol Petroleum, Lotte Chemical, Bank of Punjab, Unity Foods and Maple Leaf Cement, which formed 32pc of total turnover.

Sectors contributing to the negative performance included power, declining by 65 points, exploration and production 42 points, oil and gas marketing companies 40 points and investment banks 13 points and cement six points.

Major drag came from Hub Power, down 2.88pc, MCB 1.98pc, Oil and Gas Development Company 1.59pc, Pakistan Petroleum 1.23pc, Pakistan State Oil 2.35pc, Hascol 5.88pc and Dawood Hercules 1.06pc.

Published in Dawn, February 7th, 2020