IT has been a tumultuous month at the World Bank. The bank’s armies of analysts and economists routinely produce research on topics ranging from best practices to a variety of development issues to how to promote gender equality in emerging economies. Indeed, the vast majority of papers and research it produces apply to certain niches of analysis; they are launched and read without much ado, let alone controversy.

This was not the case with a recent working paper. Entitled Elite Capture of Foreign Aid: Evidence from Offshore Bank Accounts, it was authored by economists Jørgen Juel Andersen, Niels Johannesen and Bob Rijkers, with the support of the World Bank’s own economists, including its (now former) chief economist Penny Goldberg. According to reports, the paper had also gone through numerous reviews that helped improve and organise its findings.

The findings were damning. Using data from offshore banks in places like Switzerland, Luxembourg, the Cayman Islands, Hong Kong and Singapore, the researchers traced what happened when aid disbursements were made to some of the world’s most aid-dependent countries. Around the same time that the money was released, the researchers noted there was an increase in the number of deposits in those offshore accounts. The same correlation was found over almost a decade of economic data, by tracking aid disbursements from more than 20 different countries.

Researchers have suggested that the entire architecture of aid needs to be reconsidered.

The writing, then, was on the wall. The aid that the World Bank was giving to some of the world’s poorest countries appeared to be going directly into offshore accounts. The finding also meant that the early transmission of these funds ensured that local elites did not have to make tax payments on money that appeared to be stolen from the people. Particularly bad were countries whose GDP was made up with development aid.

There are, according to the paper itself, some alternative explanations to the sudden increase in activity of these offshore accounts. It is possible that countries with less developed credit markets moved the money to offshore accounts where it could be kept until it was allotted to various development projects. It is also possible, the economists noted, that large national organisations maintained these offshore accounts and utilised them as a way to be more, rather than less, present.

All these caveats notwithstanding, the conclusion of the paper has turned out to be controversial and damning. One obvious problem is that the raison d’être of the World Bank’s existence is to help the world’s poorest populations, the very people from whom aid was being stolen and dumped into this or that offshore account. If the paper is taken at its word, it means that aid disbursements do little to nothing for the poor, and often go directly into the already heavy pockets of corrupt economic elites.

The convulsions this one paper has produced in one of the world’s largest aid and development organisations is speculated to have led to Penny Goldberg’s resignation, after holding the position of chief economist at the bank for only a brief 15 months. The Economist accused the World Bank’s bosses of suppressing the paper’s publication. It is indeed true that the paper’s release seemed to have been delayed; then it was published by one of its authors on his own website, before finally being uploaded on the World Bank’s website for the public to access.

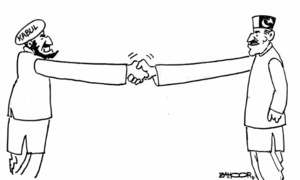

The controversy does not detract from the damning findings made by the paper. Though not included in the report, Pakistanis, long dependent on aid, know quite well ‘where the money goes’. Indeed, the political cataclysms of the country’s recent history have all been dependent on findings via Panama Papers, WikiLeaks and other sources, which have revealed the extent of corruption and graft among the country’s political elites.

At the same time, it is quite another thing altogether when the World Bank itself publishes research suggesting that its own aid disbursals can lead to as much as a 75 per cent increase in offshore account holdings. Indeed, if the bank wants to take its own work and findings seriously, it must change the course of its actions. When it publishes such research, in sum, it amounts to an admission that their most important work is a complete failure.

What the World Bank is going to do may determine the course of aid in this century. There are already compelling critiques of how the structure and means of aid disbursements do not lead to development successes or lift people out of poverty. This new paper adds even more fuel to the fire, suggesting that the entire architecture of aid needs to be reconsidered.

Economists do not talk often about morality. In this case, however, the data also reveals that economic elites in developing countries believe stealing to be an entirely acceptable proposition, fodder to fuel the expensive tastes of autocrats’ wives and other highly positioned people. If the money is being stolen with such regularity by so many and over such a long period, it follows that those who govern the world’s poorest make no bones about taking what is meant for others. This last bit is not the World Bank’s problem, but it is something to think about.

Morality aside, the paper and the resignation of the chief economist, along with allegations made in the media, all mean that some significant changes are around the corner. Evil middlemen — we know so many who have stolen with impunity — may soon have far fewer opportunities to steal. Of course, the very poor will continue to lose out; they never got what was meant for them, and perhaps they never will.

The writer is an attorney teaching constitutional law and political philosophy.

Published in Dawn, February 26th, 2020