Trading at the Pakistan Stock Exchange was paused for 45 minutes on Monday, seven minutes after the opening bell, after the benchmark index dropped 2,106 points.

According to reports from the market, trading was halted at around 9:37am after a rapid 5.83 per cent decline (2,106 points) in share prices.

After trading resumed at 10:24am, stocks continued their slide to reach the largest ever intra-day plunge in Pakistan's history. By 10:35am, the benchmark index was down 2,302 points or 6.02pc.

Today's plunge surpassed the previous record for the highest intra-day loss, when the market had registered a fall of 5.16pc – around 300 points – to reach 5,571 on Feb 25, 2009.

But soon after reaching its nadir, the market began reversing and by the day's close, stocks had recovered 1,137 of the 2,302 points lost earlier in the day.

At market close, the KSE-100 index stood at 37,054 points – down 3.12pc or 1,165 points.

Trading halted for 45 mins

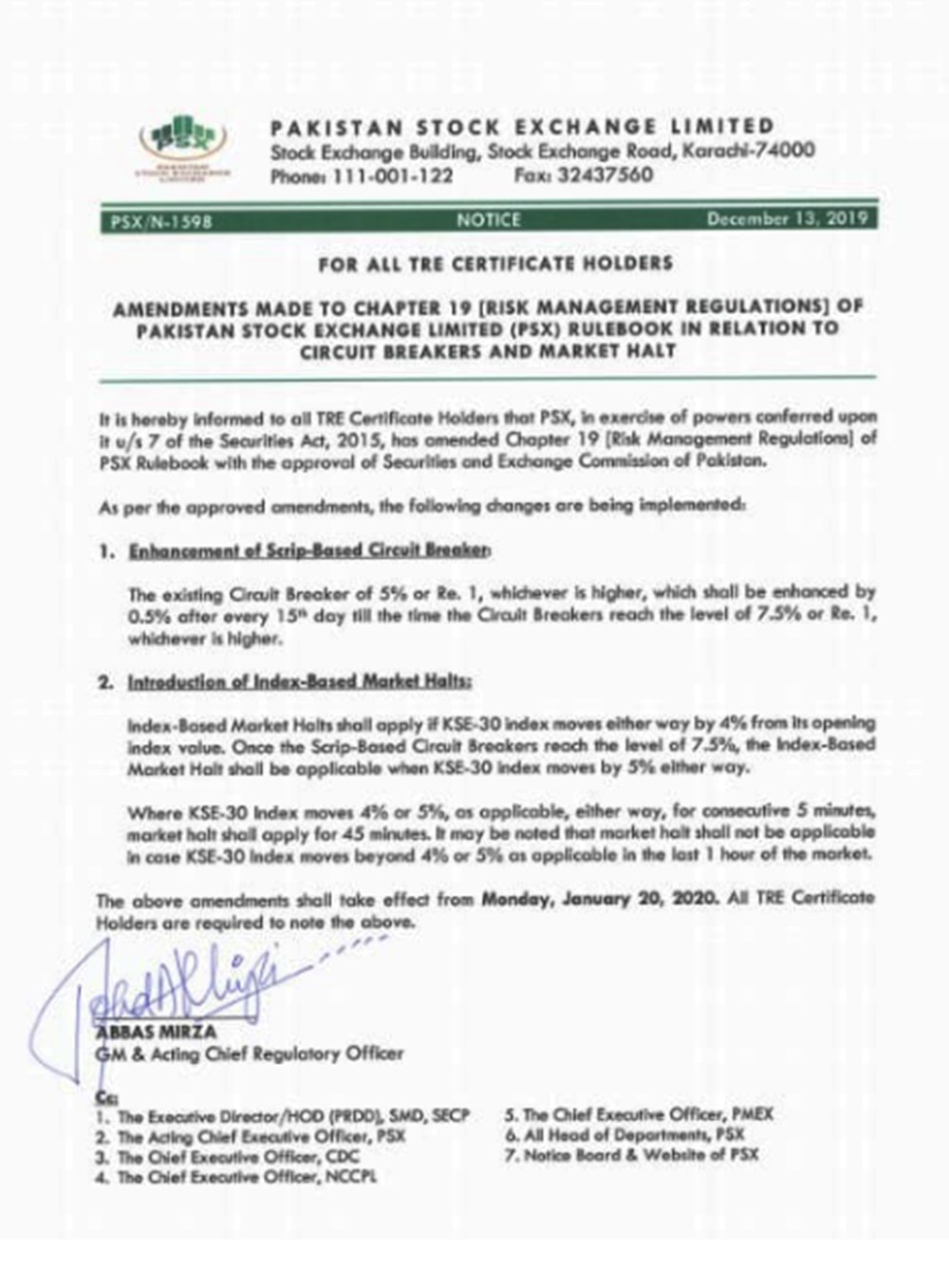

According to new bourse rules, if the KSE-30 index moves 4pc or more in any direction, trading is halted for 45 minutes, experts told Dawn.com.

A spokesperson of the Securities and Exchange Commission of Pakistan said a market halt rule had been introduced by the SECP a few months ago "to deal with such panic situations".

SECP is monitoring the situation to ensure fair and transparent trading, he added. He said the break in trading gives companies time to collect margins and settle trade.

"It also gives companies and investors a cooling period to settle down. After margins have been collected successfully, trading session is resumed."

Discussing the tumble with Dawn.com, Deputy Head of Research at AKD Securities, Ali Asghar Poonawala, said: "Following the failure of Organisation of the Petroleum Exporting Countries (Opec) talks to yield any consensus on output cuts and ongoing spread of COVD-19 virus beyond China, crude benchmarks tumbled drastically with Brent down close to 31% – the most drastic decline since the 1991 Gulf War."

Poonawala said oil exploration and production companies constitute 15.3pc of the total market capitalisation. These companies also make up 13.2pc of the KSE-100 index with Oil & Gas Development Co (OGDC) being the second largest stock by market cap.

"With no Opec deal on the horizon, previous cuts of 1.7million barrels per day (bpd) agreed upon by the 23 country cartel will likely expire, unleashing significant supply upswing.

"Additionally, from early January peaks, crude benchmarks had already shed 30pc of their value on the back of coronavirus spreading beyond China and spillovers for global economic growth," Poonawala said.

Head of Foreign Institutional Sales at Next Capital Limited Muhammad Faizan told Dawn.com that markets have been falling internationally due to coronavirus and Russia's decision to back out of the Opec deal.

International oil prices fell by as much as a third when Saudi Arabia decided to start a trade war after Russia refused to back further steep output cuts proposed by Opec to stabilise oil markets hit by worries over the global spread of the coronavirus.

Saudi Arabia over the weekend cut its official selling prices for April for all crude grades to all destinations by between $6 and $8 a barrel.

Saudi Arabia plans to boost its crude output above 10 million bpd in April after the current deal to curb production expires at the end of March, two sources told Reuters on Sunday.

Sea of red

Trading floors were a sea of red, with Tokyo, Sydney and Manila plunging around six percent, while Hong Kong shed 3.5 percent by lunch.

Mumbai, Singapore, Seoul, Jakarta and Wellington were more than three percent down, Shanghai and Taipei shed at least two percent and Bangkok gave up five percent. The losses tracked sharp falls in Europe and Wall Street on Friday.

With additional input from Sanaullah and AFP